2.6 — Long Run Industry Equilibrium

ECON 306 • Microeconomic Analysis • Spring 2021

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/microS21

microS21.classes.ryansafner.com

Firm's Long Run Supply Decisions

Firm Decisions in the Long Run I

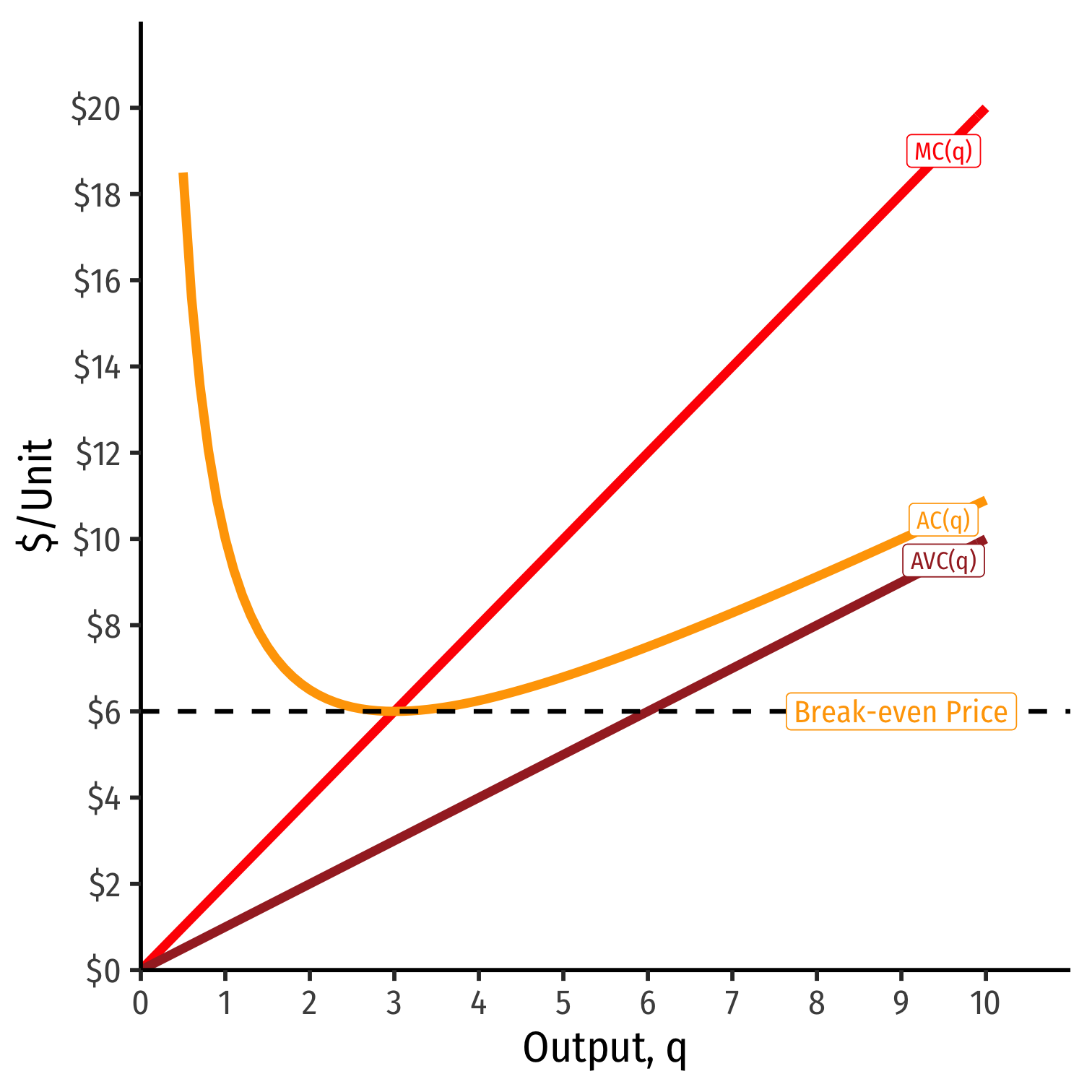

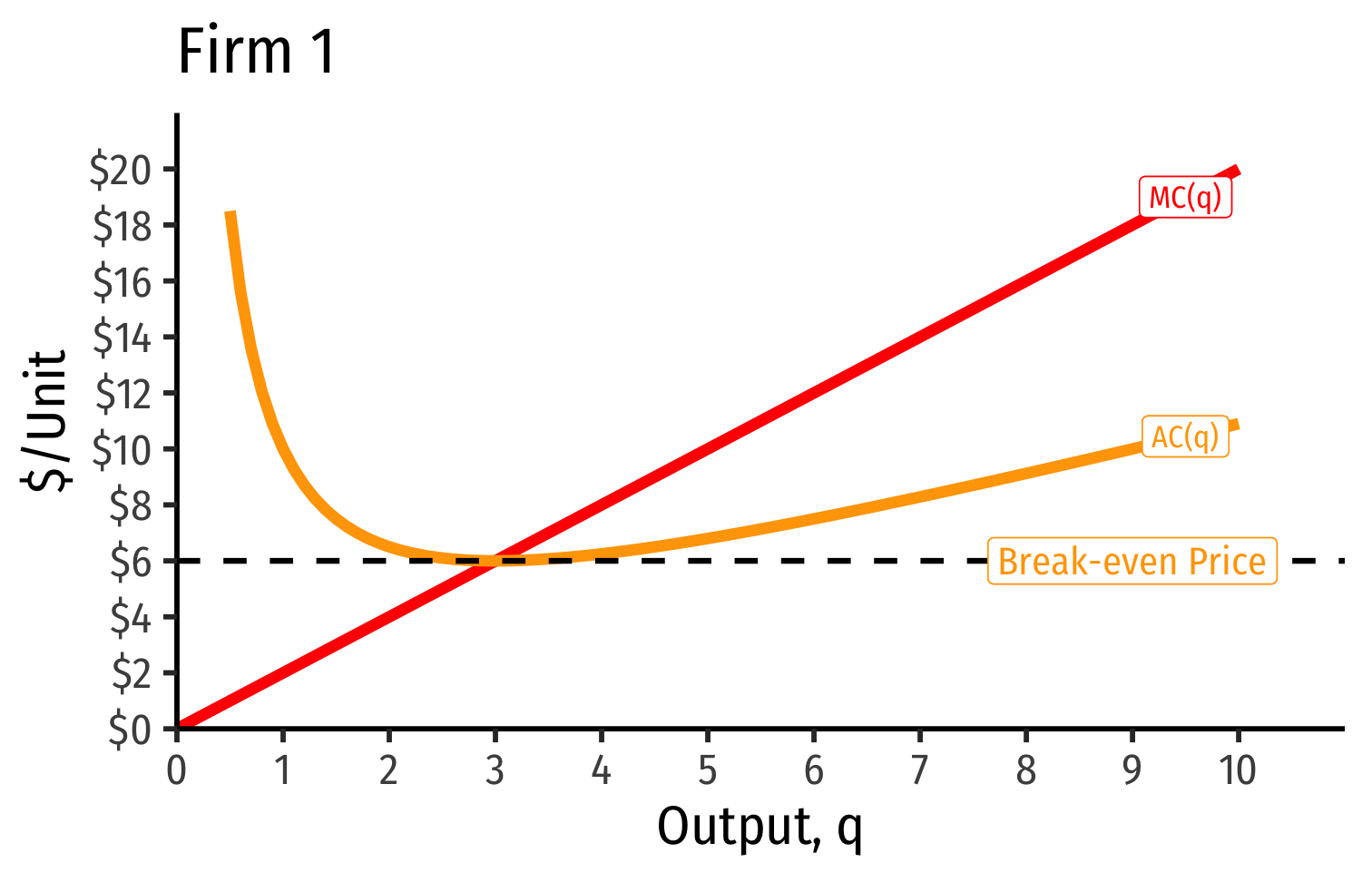

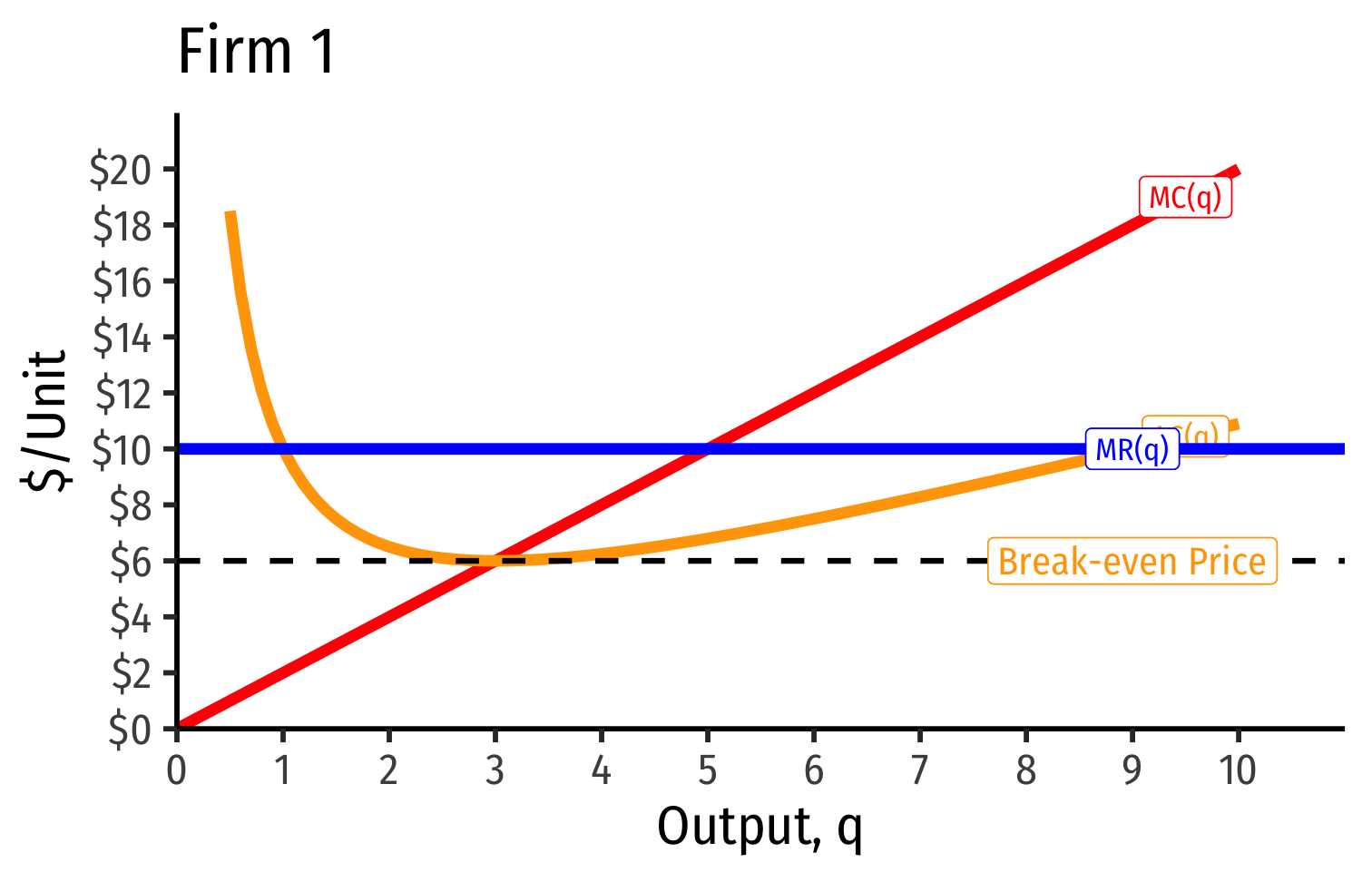

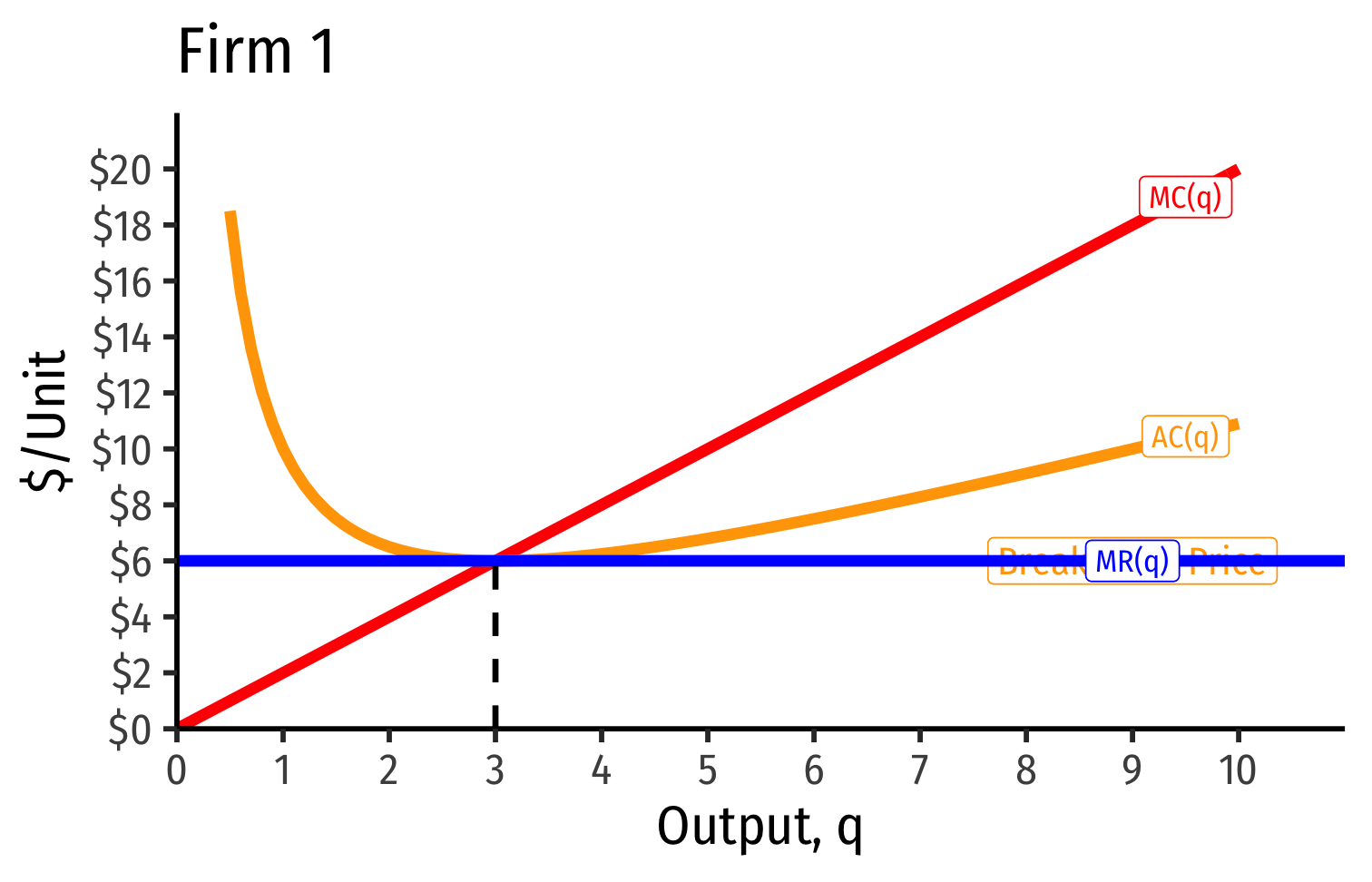

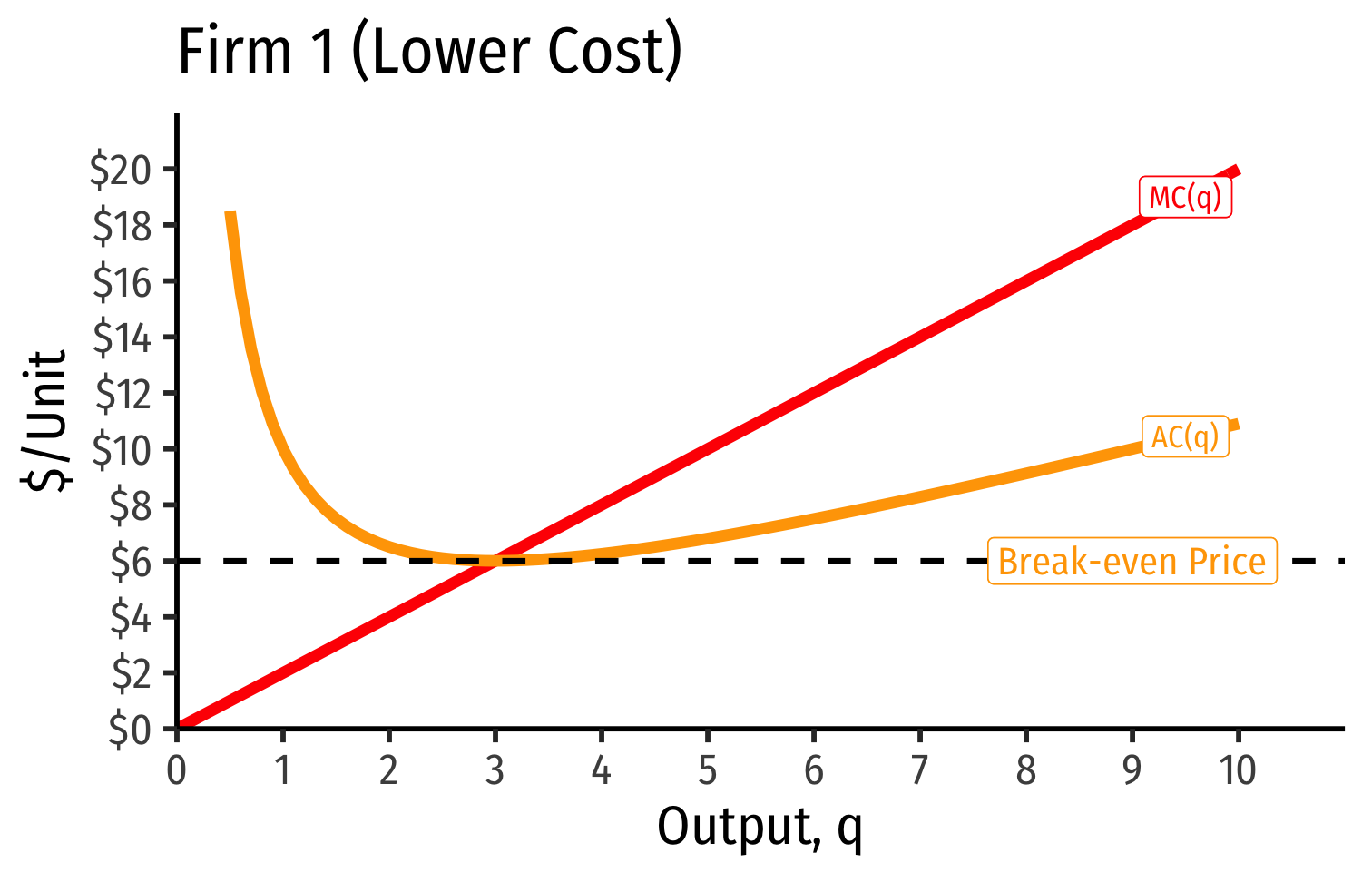

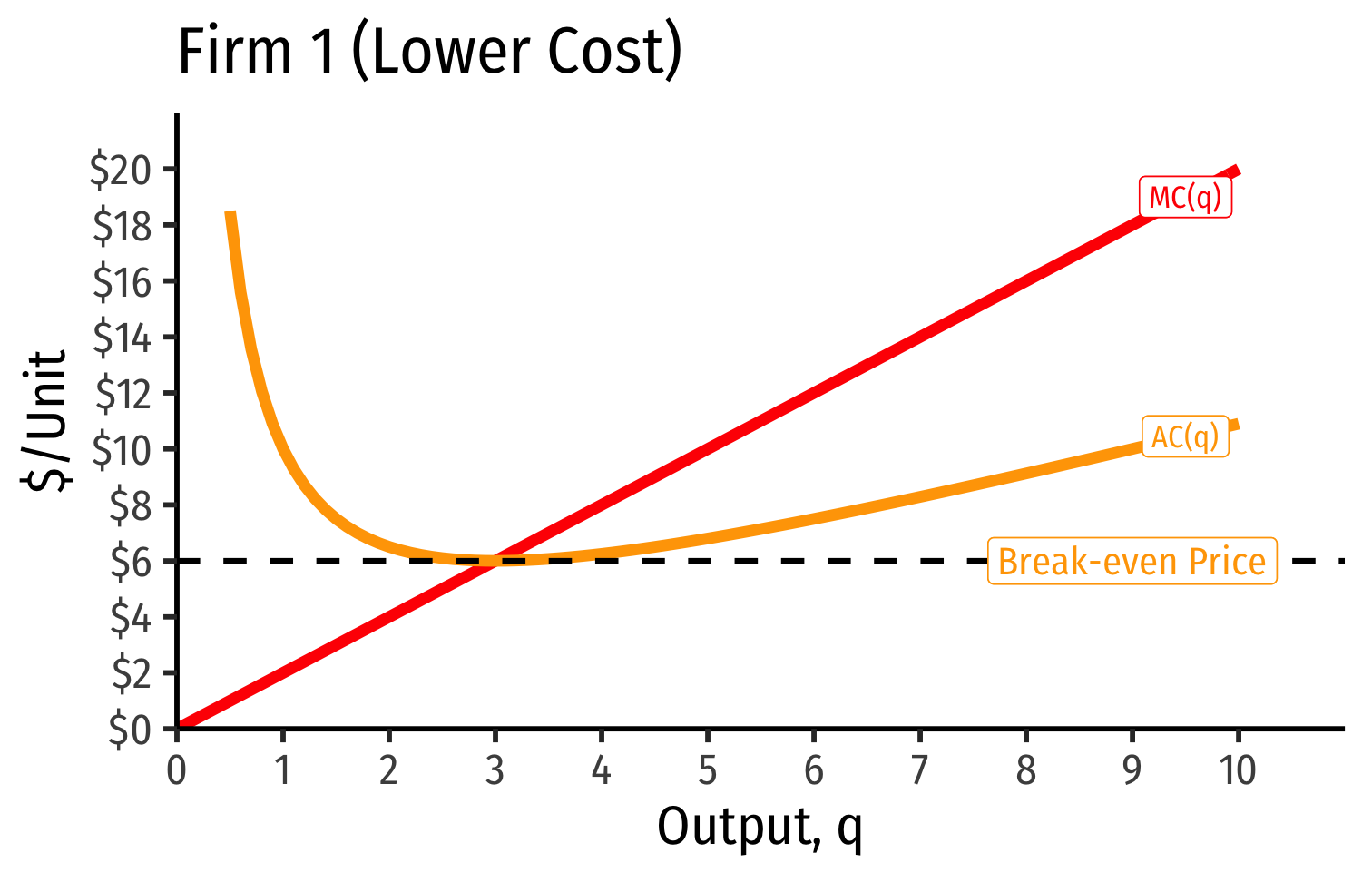

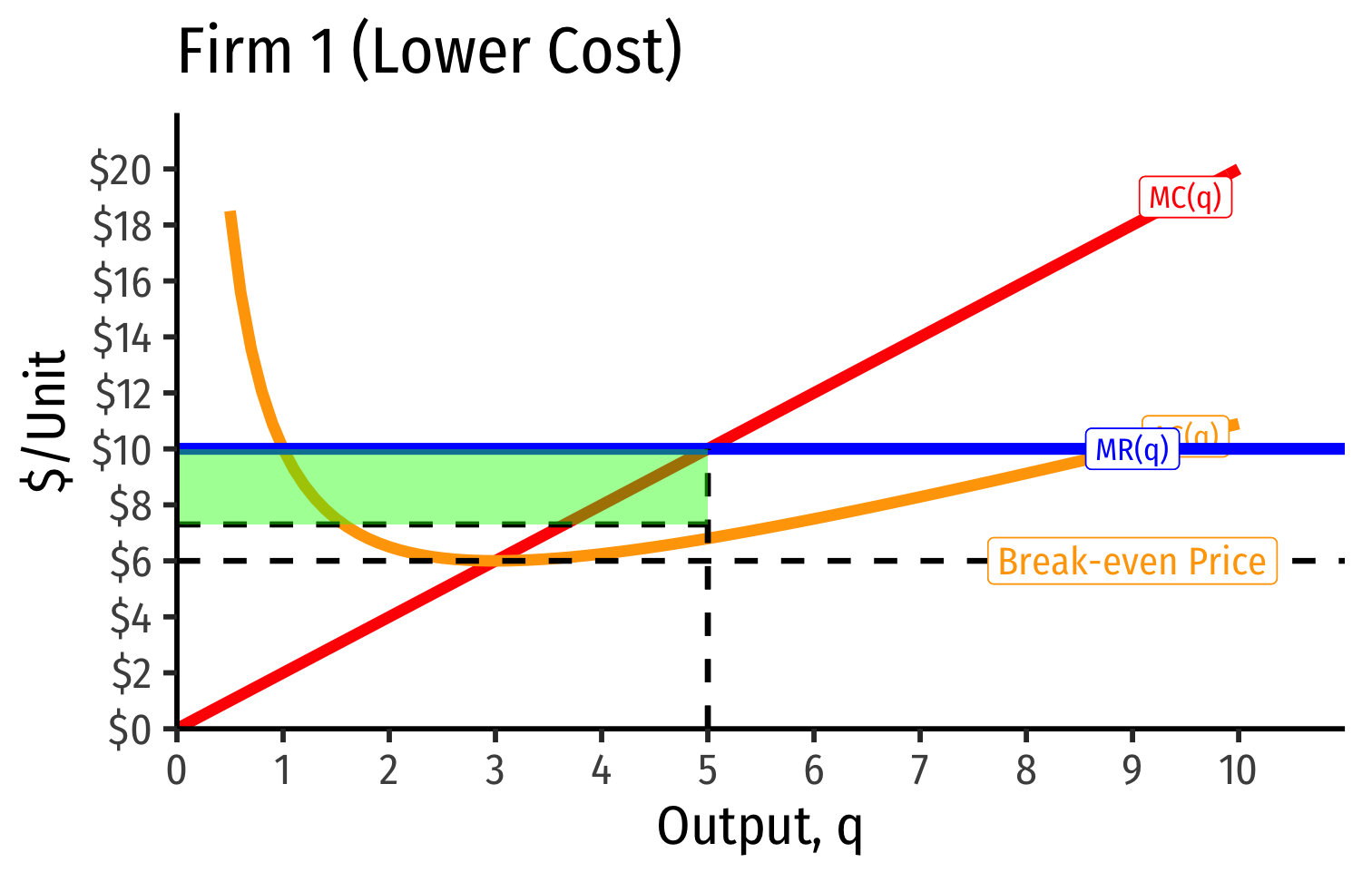

\(\color{orange}{AC(q)_{min}}\) at a market price of $6

At $6, the firm earns "normal economic profits" (of 0)

At any market price below $6.00, firm earns losses

- Short Run: firm shuts down if \(p<AVC(q)\)

At any market price above $6.00, firm earns "supernormal profits" (>0)

Firm Supply Decisions in the Short Run vs. Long Run

- Short run: firms that shut down \((q^*=0)\) stuck in market, incur fixed costs \(\pi=-f\)

Firm Supply Decisions in the Short Run vs. Long Run

Short run: firms that shut down \((q^*=0)\) stuck in market, incur fixed costs \(\pi=-f\)

Long run: firms earning losses \((\pi < 0)\) can exit the market and earn \(\pi=0\)

- No more fixed costs, firms can sell/abandon \(f\) at \(q^*=0\)

Firm Supply Decisions in the Short Run vs. Long Run

Short run: firms that shut down \((q^*=0)\) stuck in market, incur fixed costs \(\pi=-f\)

Long run: firms earning losses \((\pi < 0)\) can exit the market and earn \(\pi=0\)

- No more fixed costs, firms can sell/abandon \(f\) at \(q^*=0\)

Entrepreneurs not currently in market can enter and produce, if entry would earn them \(\pi>0\)

Firm Supply Decisions in the Short Run vs. Long Run

Firm Supply Decisions in the Short Run vs. Long Run

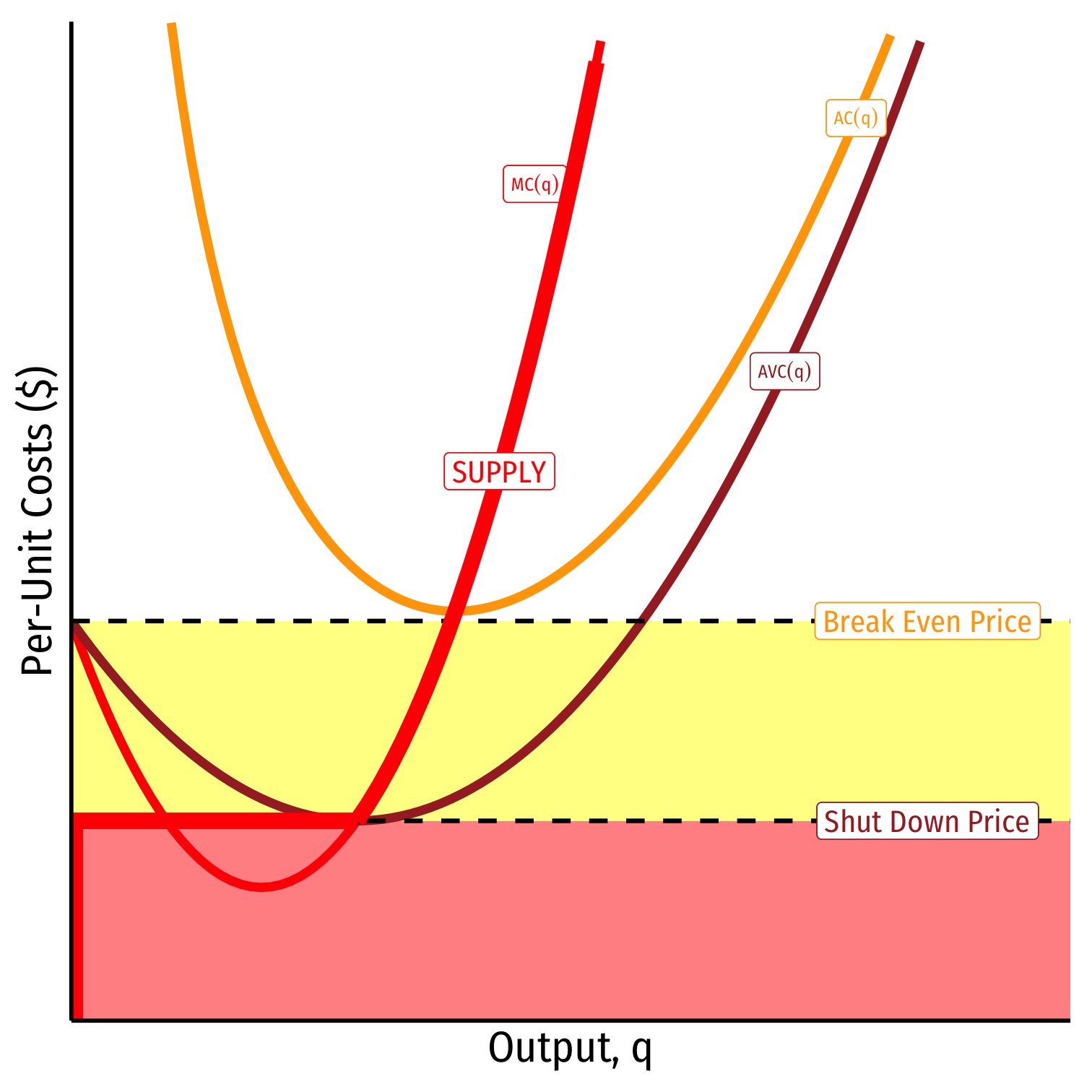

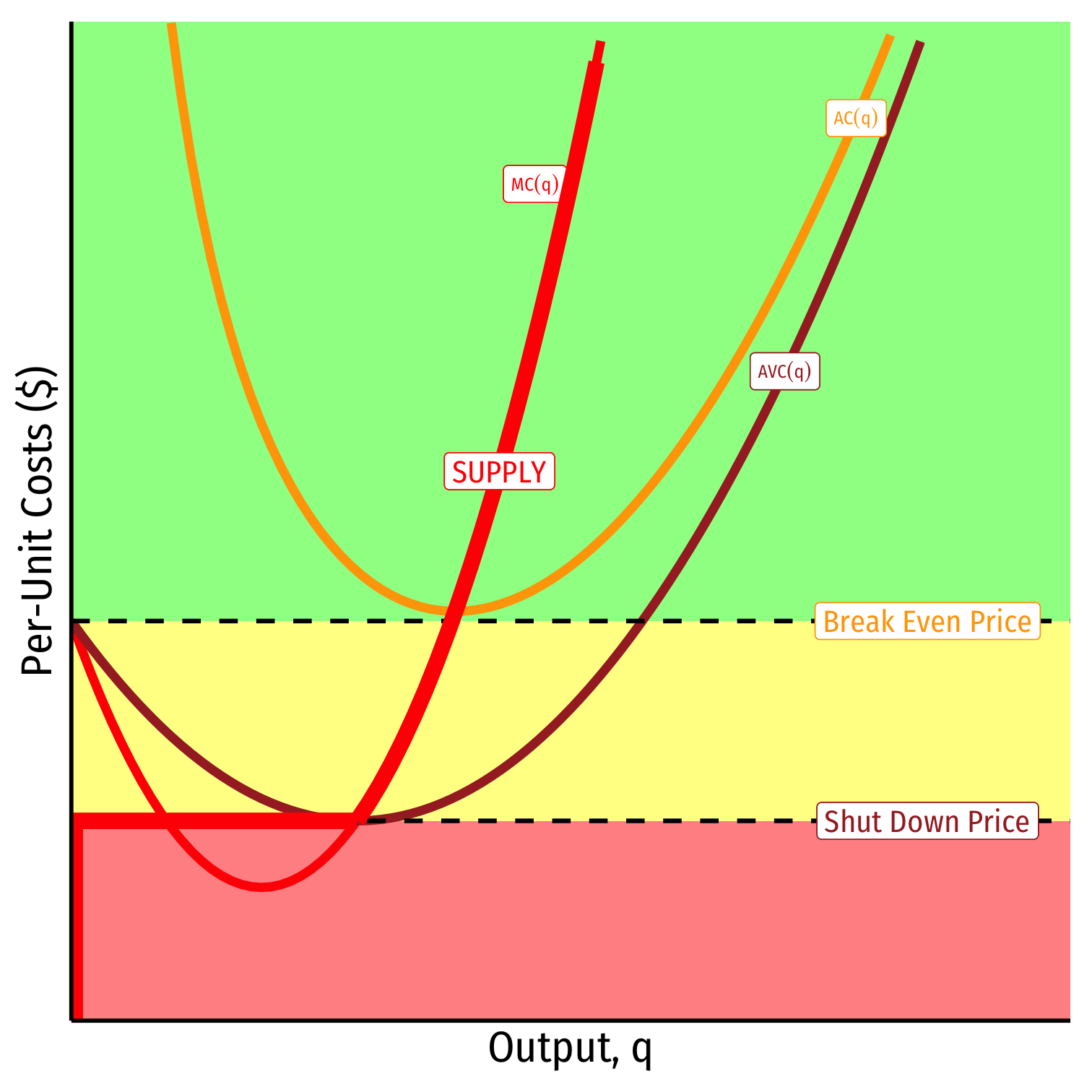

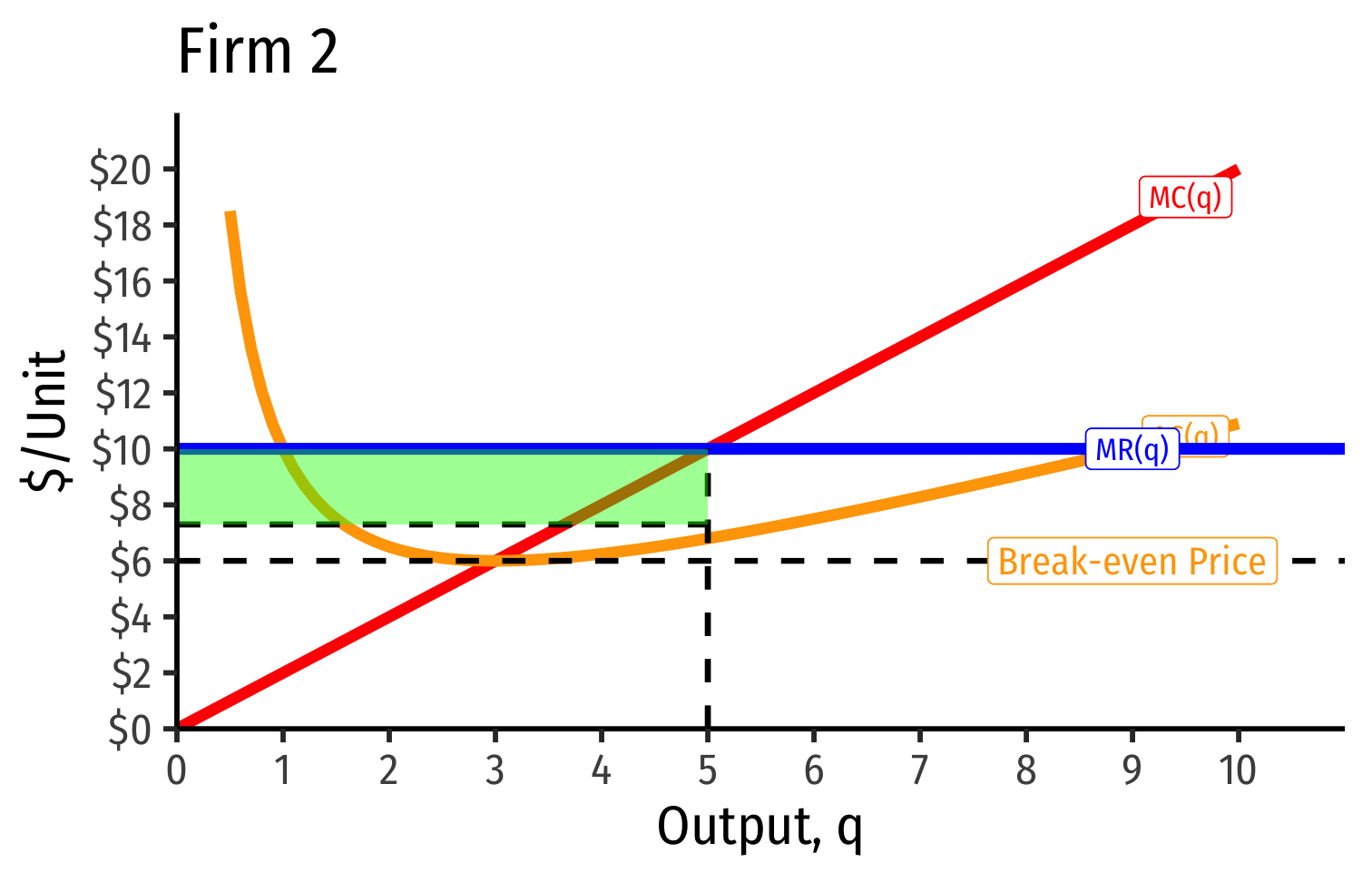

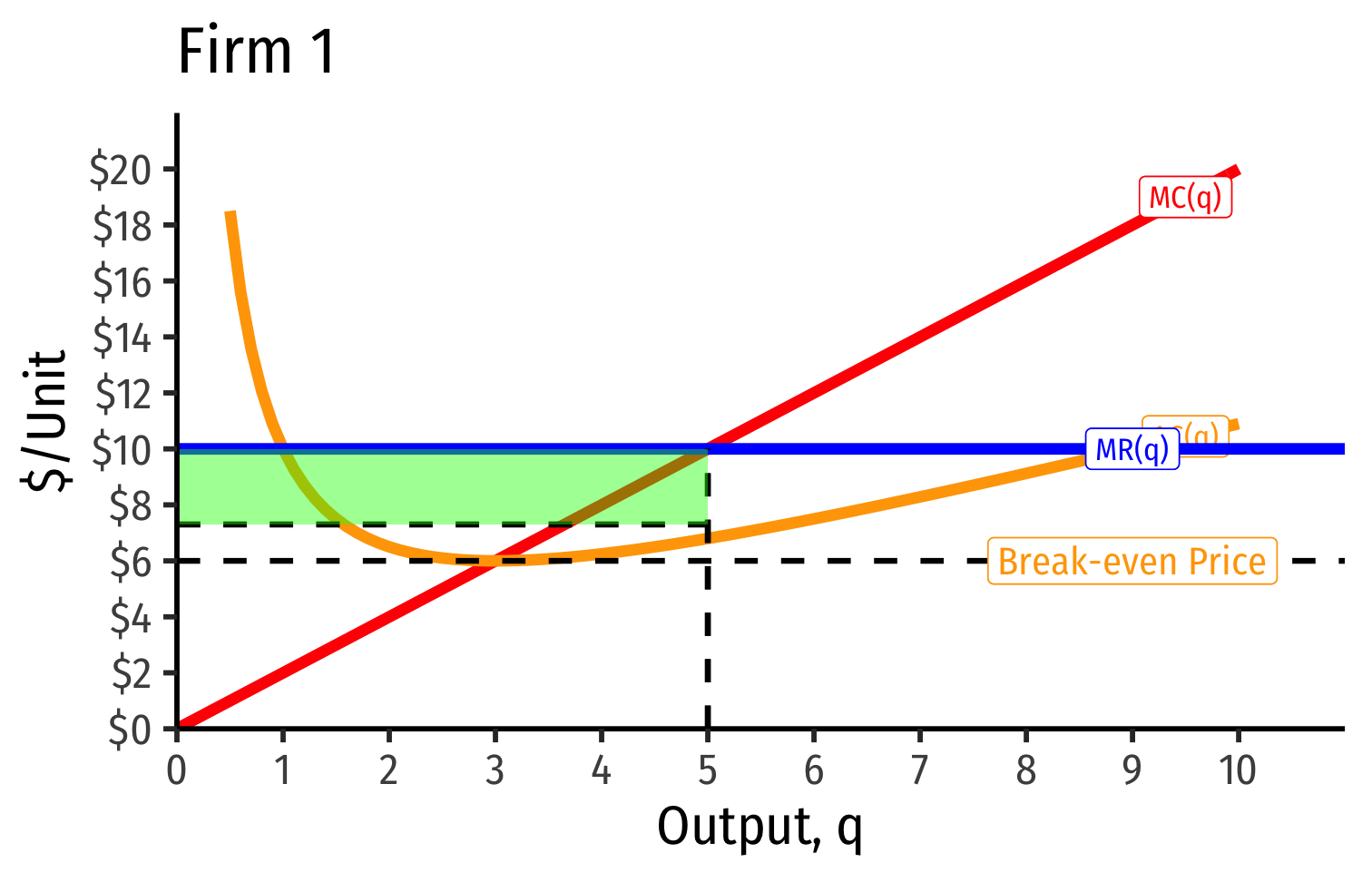

Firm's Long Run Supply: Visualizing

When \(p<AVC\)

Profits are negative

Short run: shut down production

- Firm loses more \(\pi\) by producing than by not producing

Long run: firms in industry exit the industry

- No new firms will enter this industry

Firm's Long Run Supply: Visualizing

When \(AVC<p<AC\)

Profits are negative

Short run: continue production

- Firm loses less \(\pi\) by producing than by not producing

Long run: firms in industry exit the industry

- No new firms will enter this industry

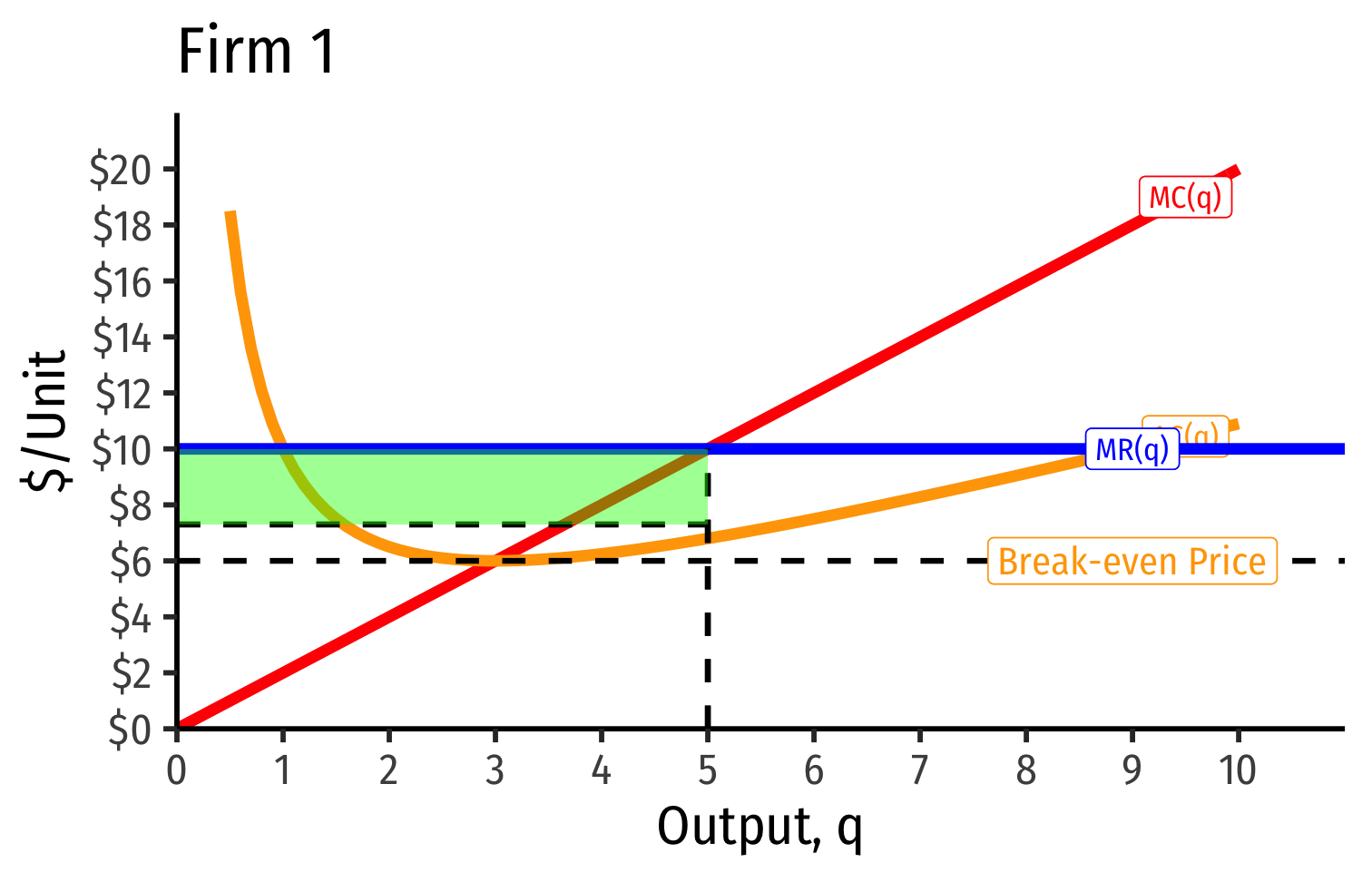

Firm's Long Run Supply: Visualizing

When \(AC<p\)

Profits are positive

Short run: continue production

- Firm earning profits

Long run: firms in industry stay in industry

- New firms will enter this industry

Production Rules, Updated:

1. Choose \(q^*\) such that \(MR(q)=MC(q)\)

2. Profit \(\pi=q[p-AC(q)]\)

3. Shut down in short run if \(p<AVC(q)\)

4. Exit in long run if \(p<AC(q)\)

Market Entry and Exit

Exit, Entry, and Long Run Industry Equilibrium I

Now we must combine optimizing individual firms with market-wide adjustment to equilibrium

Since \(\pi = [p-AC(q)]q\), in the long run, profit-seeking firms will:

Exit, Entry, and Long Run Industry Equilibrium I

Now we must combine optimizing individual firms with market-wide adjustment to equilibrium

Since \(\pi = [p-AC(q)]q\), in the long run, profit-seeking firms will:

- Enter markets where \(p>AC(q)\)

Exit, Entry, and Long Run Industry Equilibrium I

Now we must combine optimizing individual firms with market-wide adjustment to equilibrium

Since \(\pi = [p-AC(q)]q\), in the long run, profit-seeking firms will:

- Enter markets where \(p>AC(q)\)

- Exit markets where \(p<AC(q)\)

Exit, Entry, and Long Run Industry Equilibrium II

- Long-run equilibrium: entry and exit ceases when \(p=AC(q)\) for all firms, implying normal economic profits of \(\pi=0\)

Exit, Entry, and Long Run Industry Equilibrium II

Long-run equilibrium: entry and exit ceases when \(p=AC(q)\) for all firms, implying normal economic profits of \(\pi=0\)

Zero Economic Profits Theorem: long run economic profits for all firms in a competitive industry are 0

Firms must earn an accounting profit to stay in business

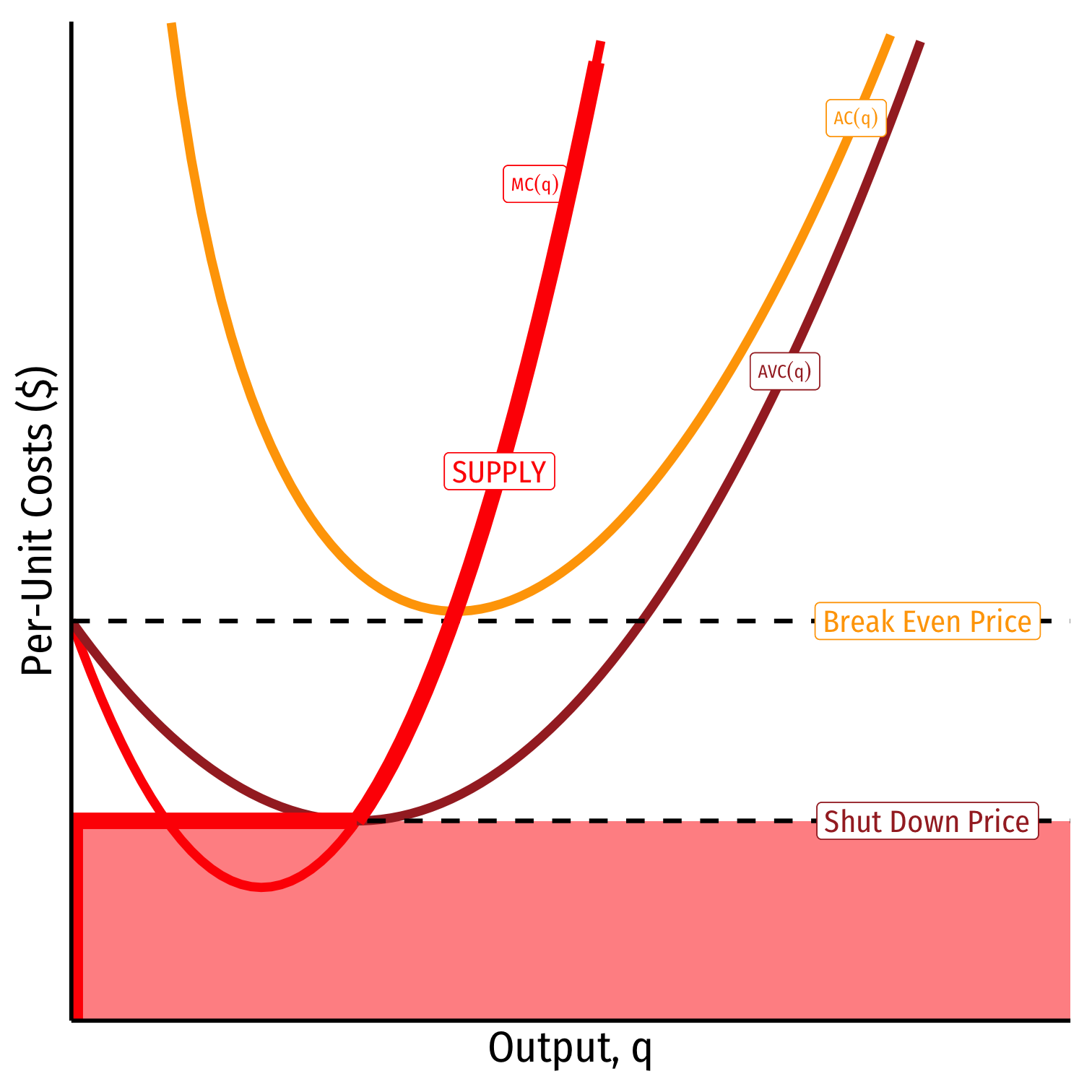

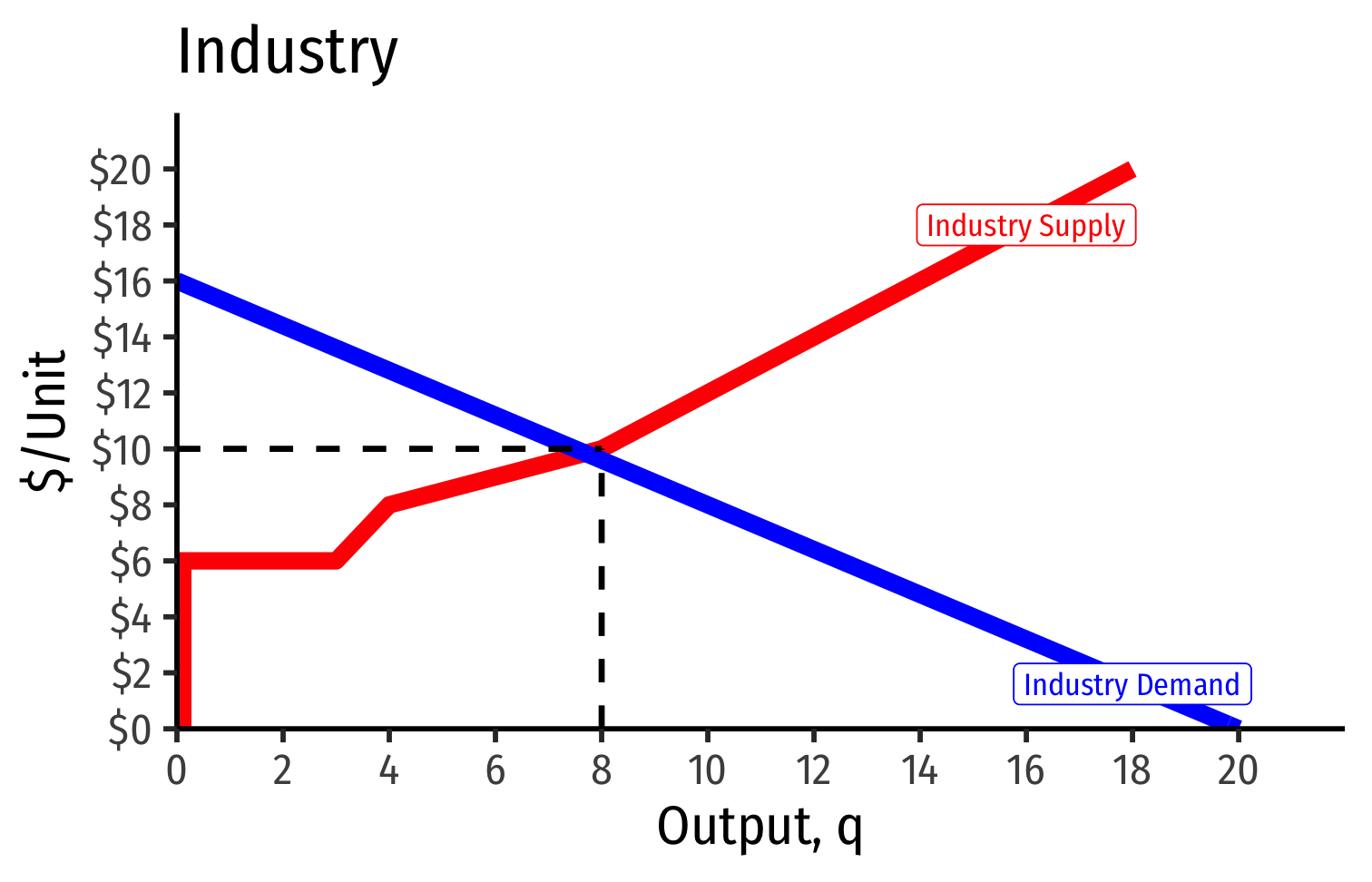

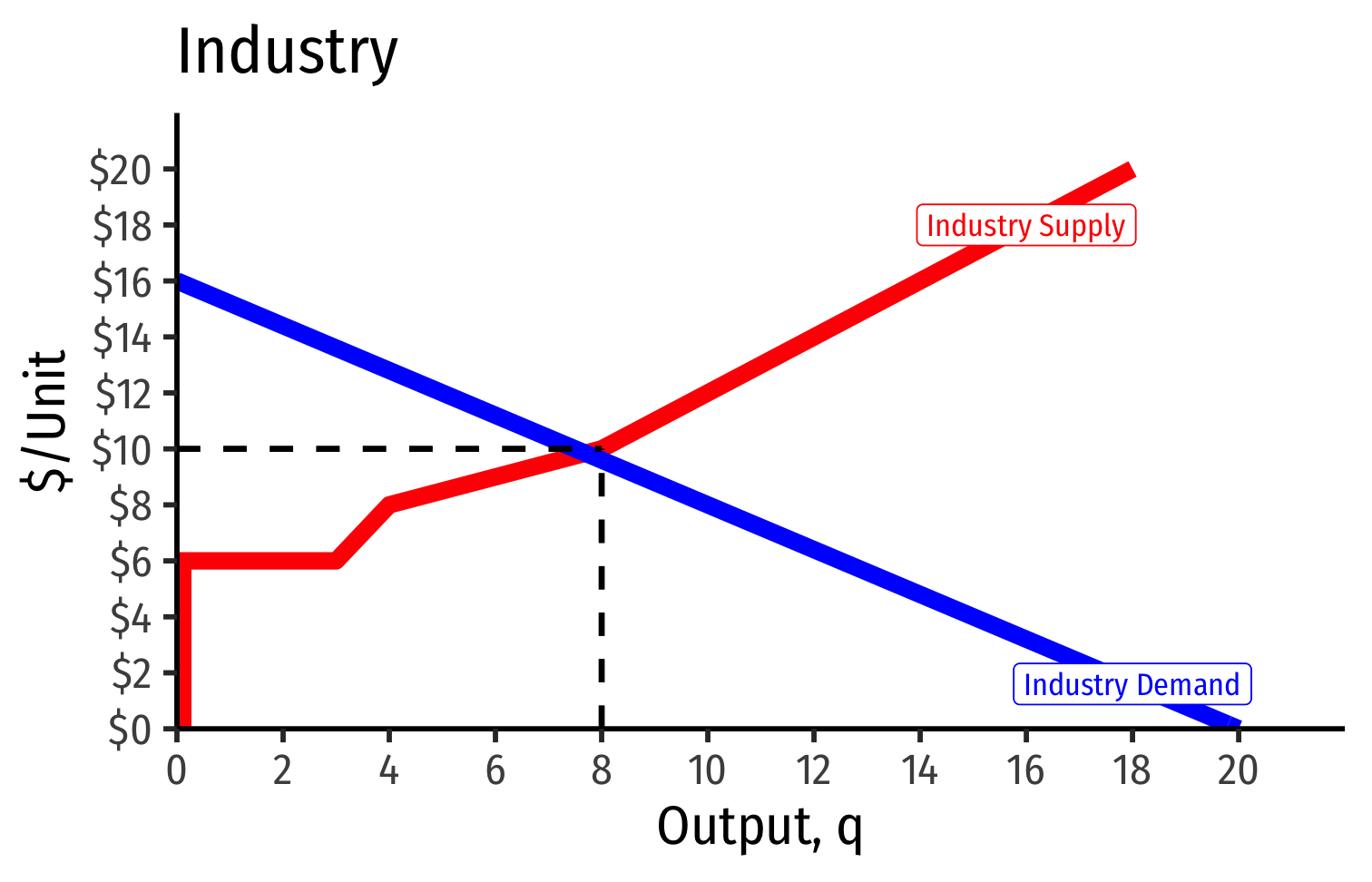

Deriving the Industry Supply Curve

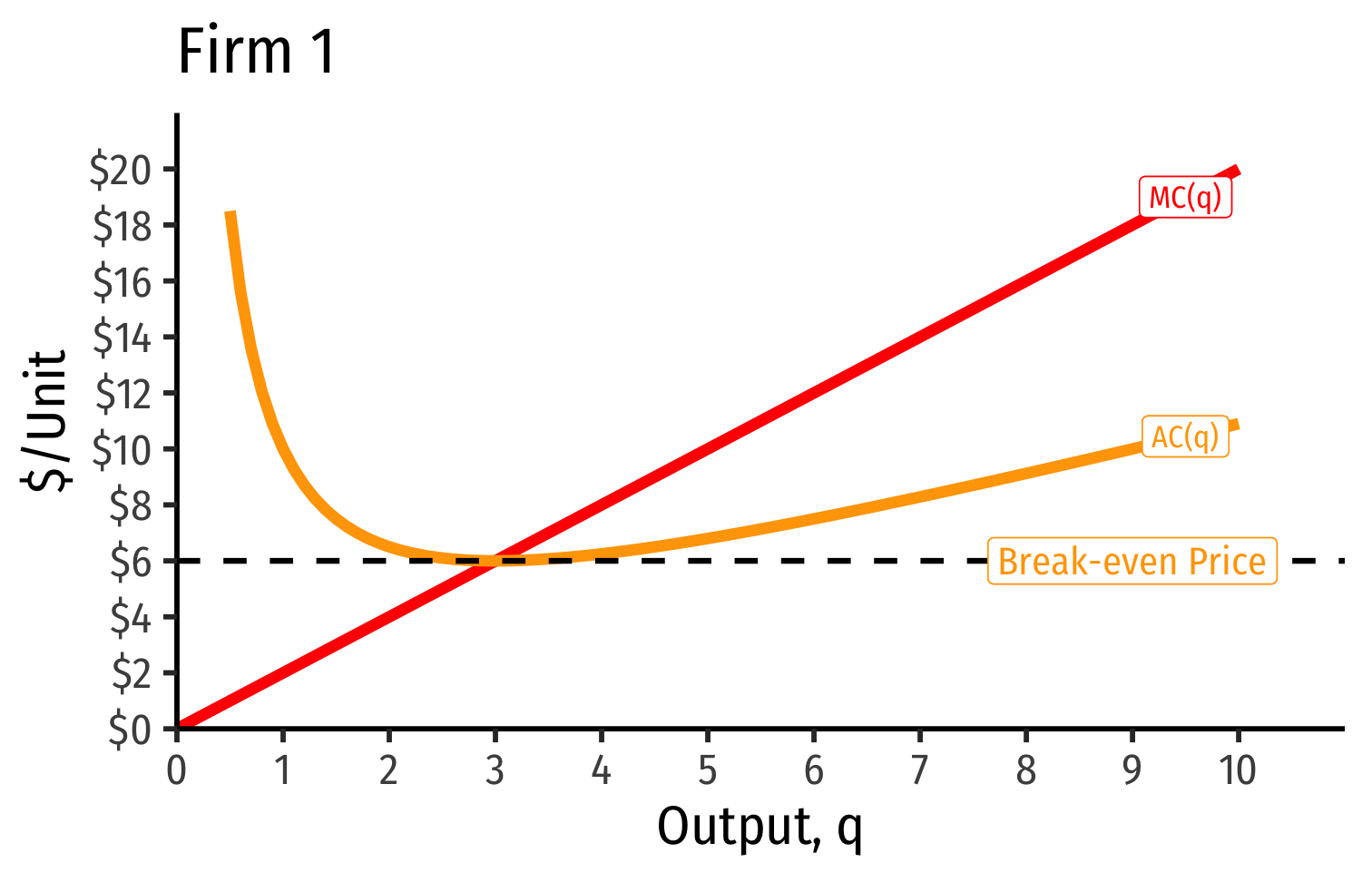

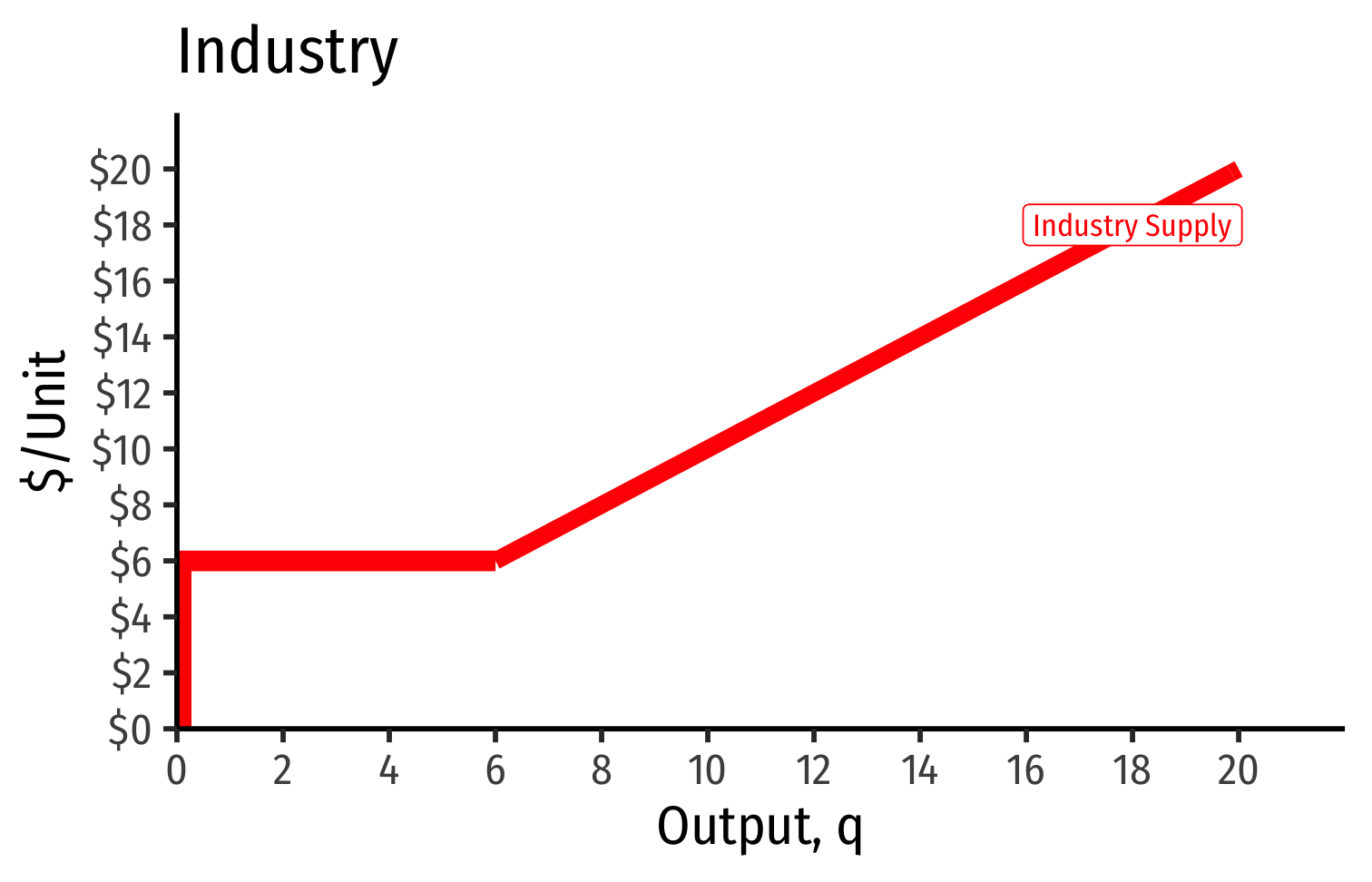

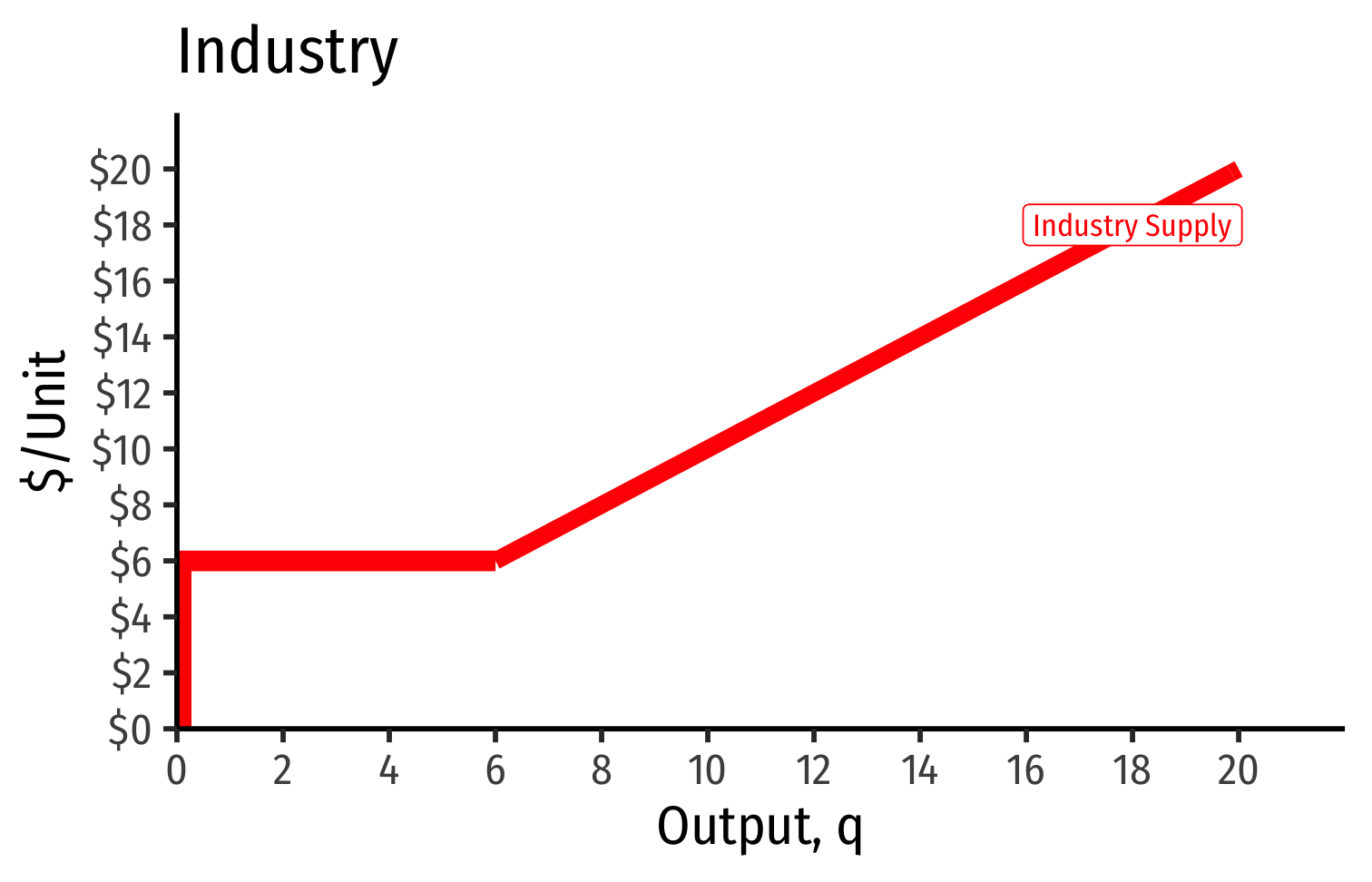

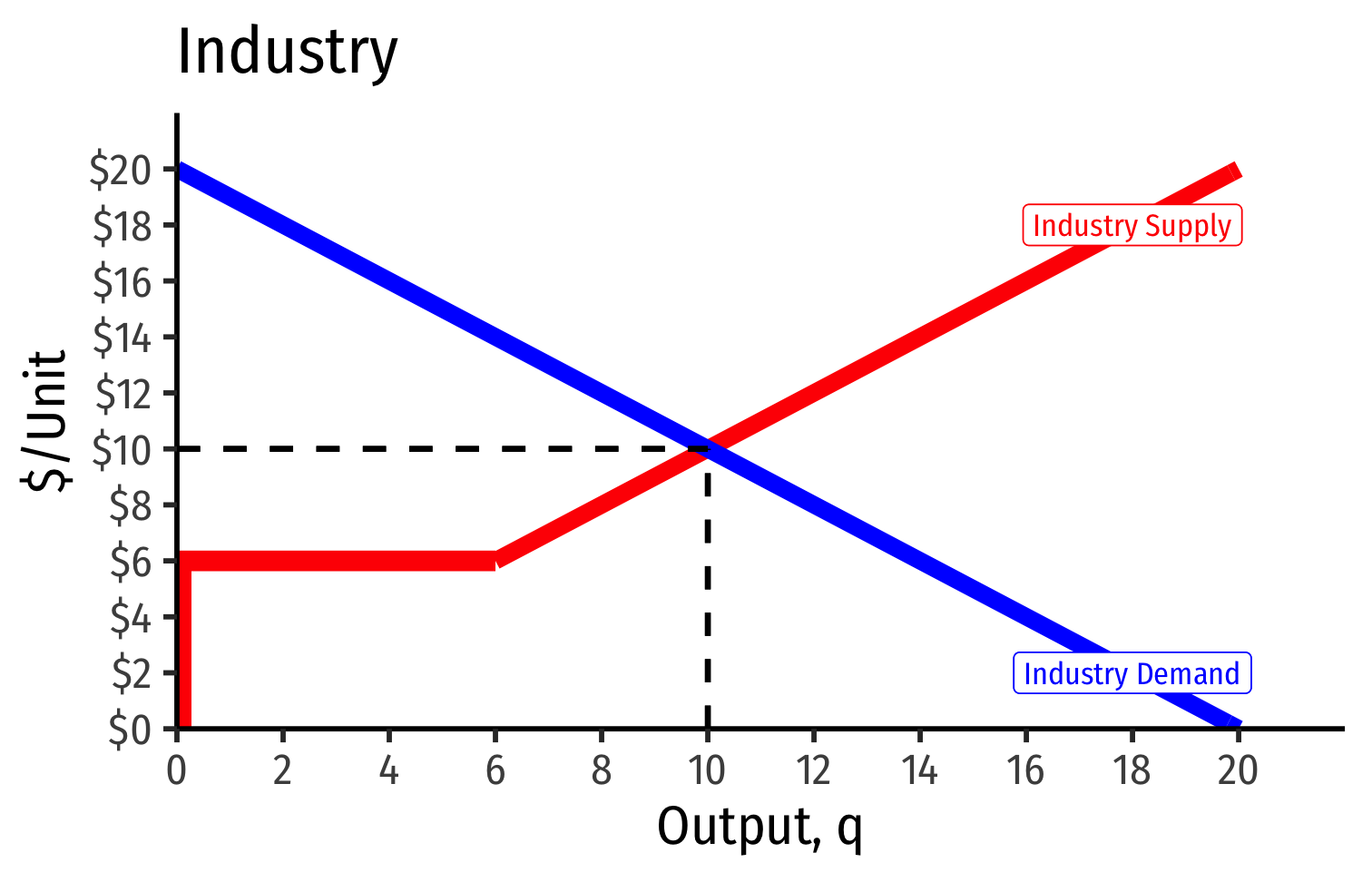

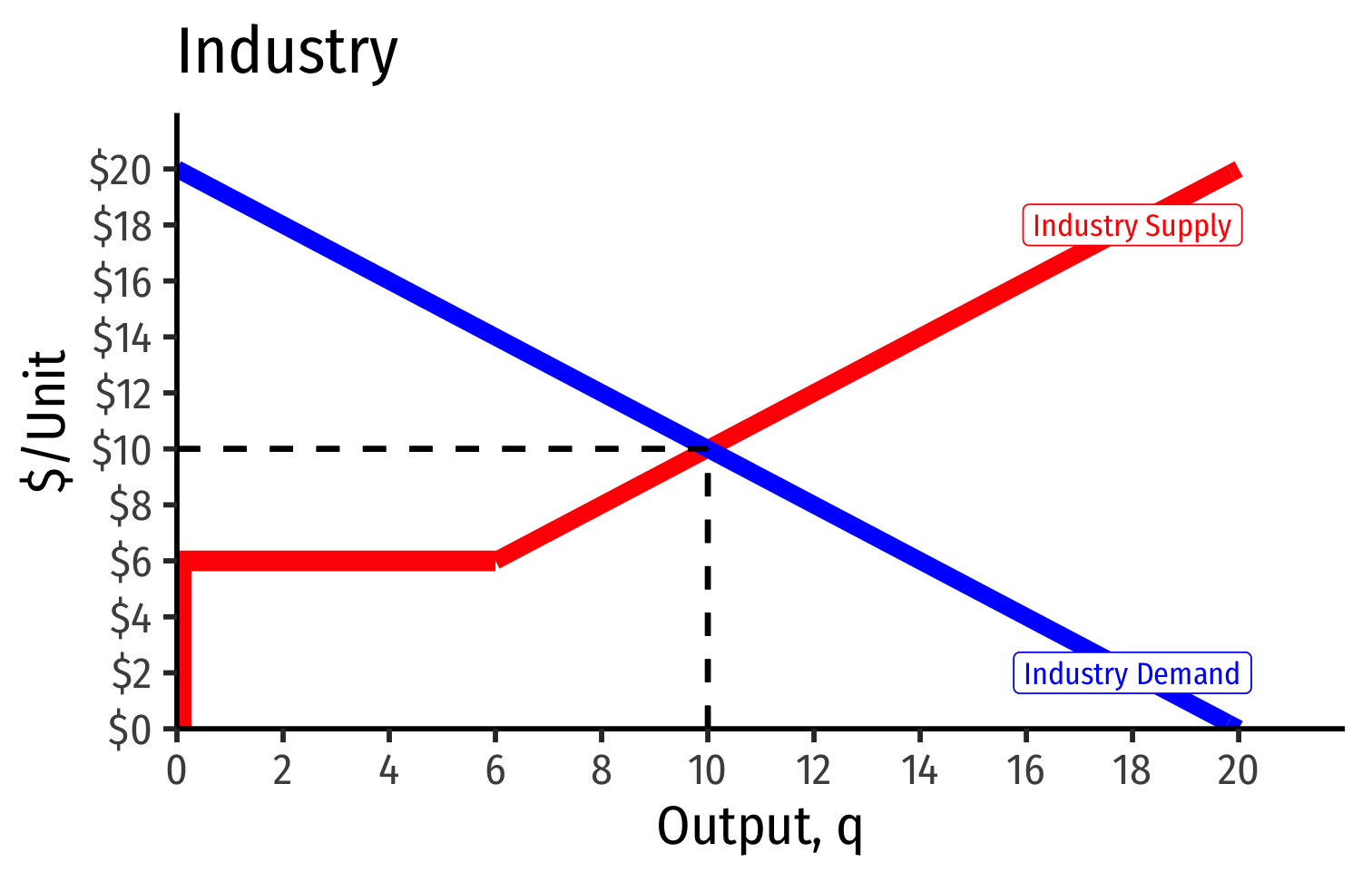

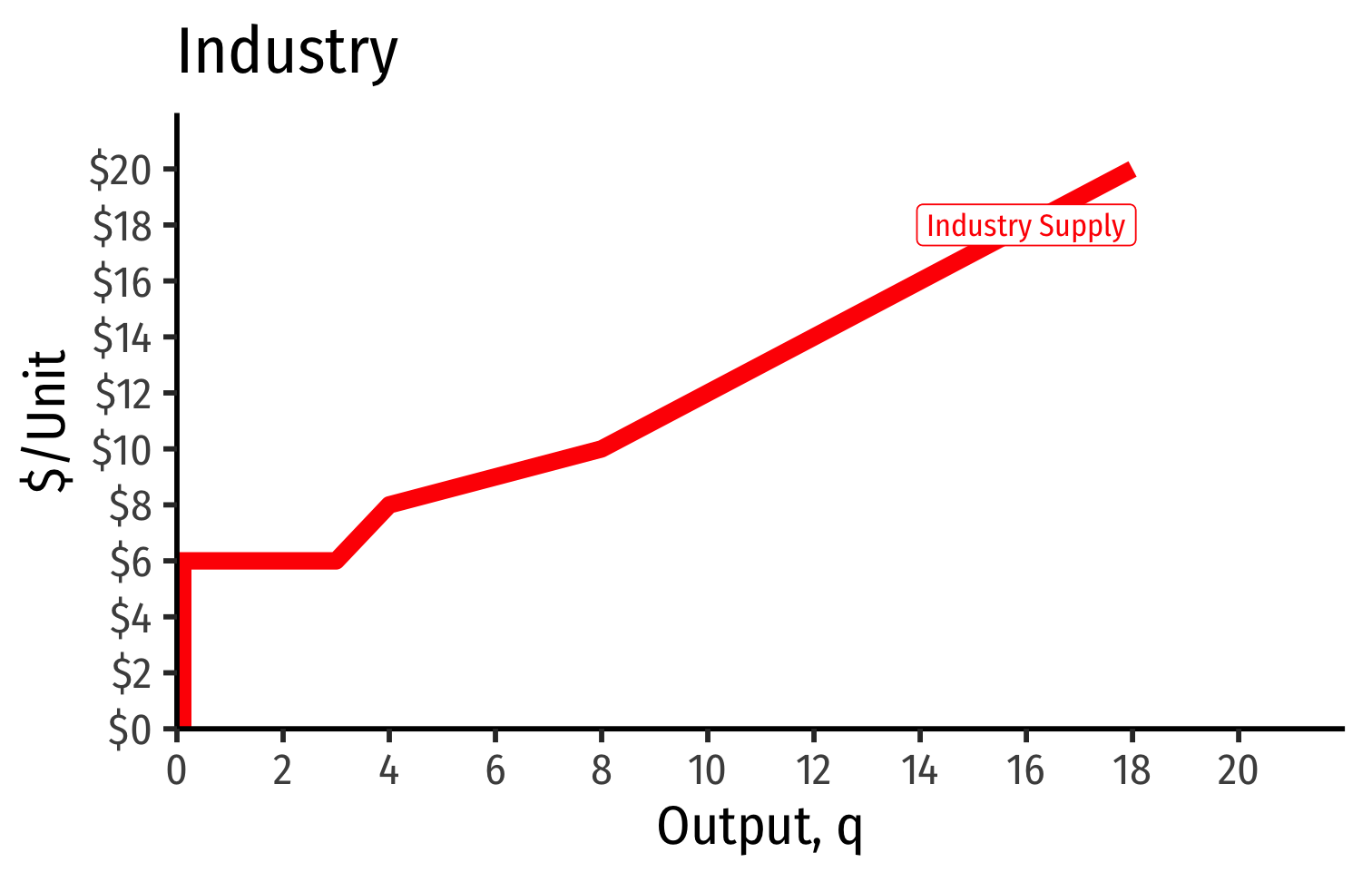

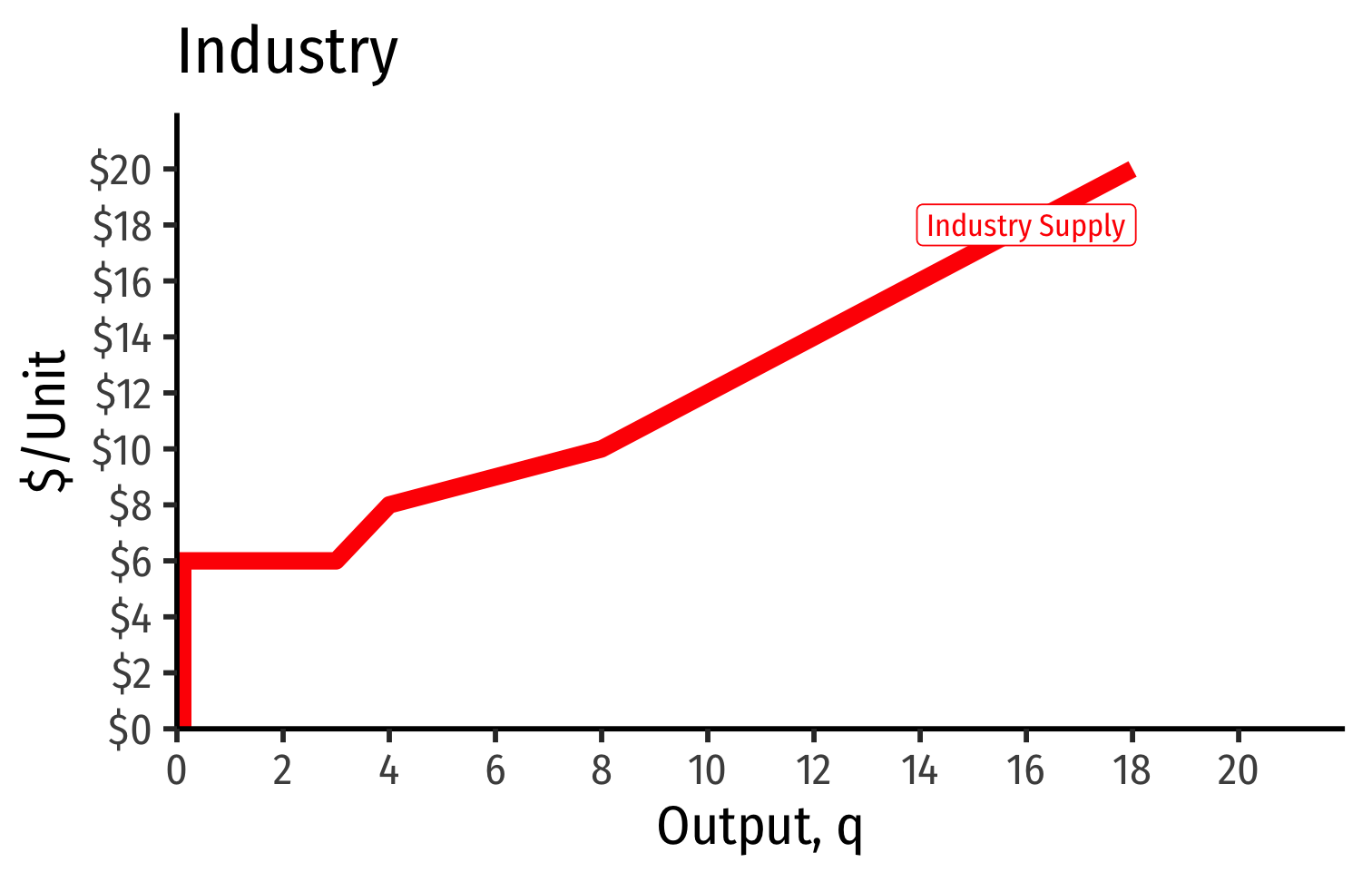

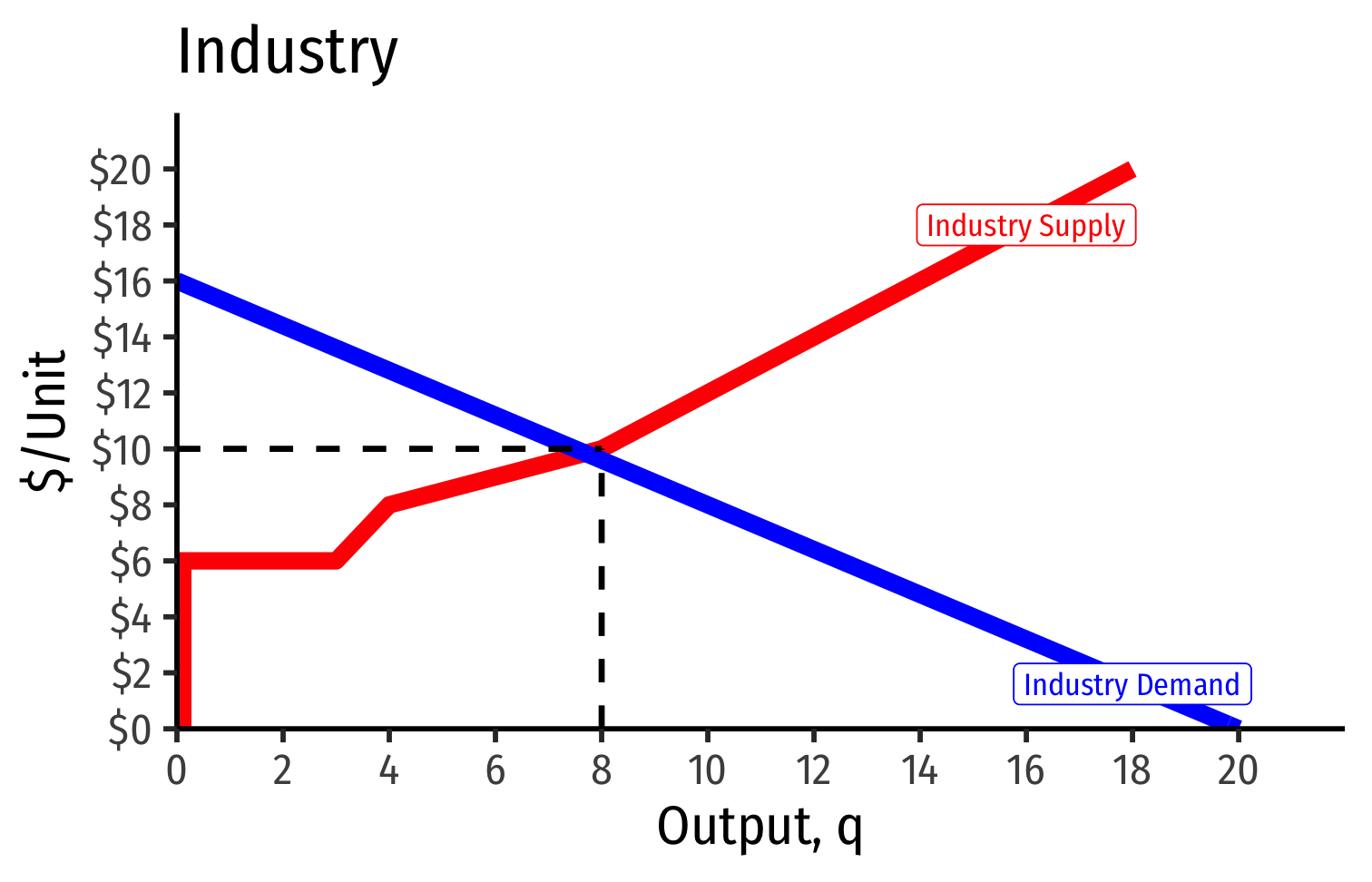

The Industry Supply Curve

Industry supply curve: horizontal sum of all individual firms' supply curves

- recall: \((MC(q)\) curve above \(AVC_{min})\) (shut down price)

To keep it simple on the following slides:

- assume no fixed costs, so \(AC(q)=AVC(q)\)

- then industry supply curve is sum of individual \(MC(q)\) curves above \(AC(q)_{min}\)

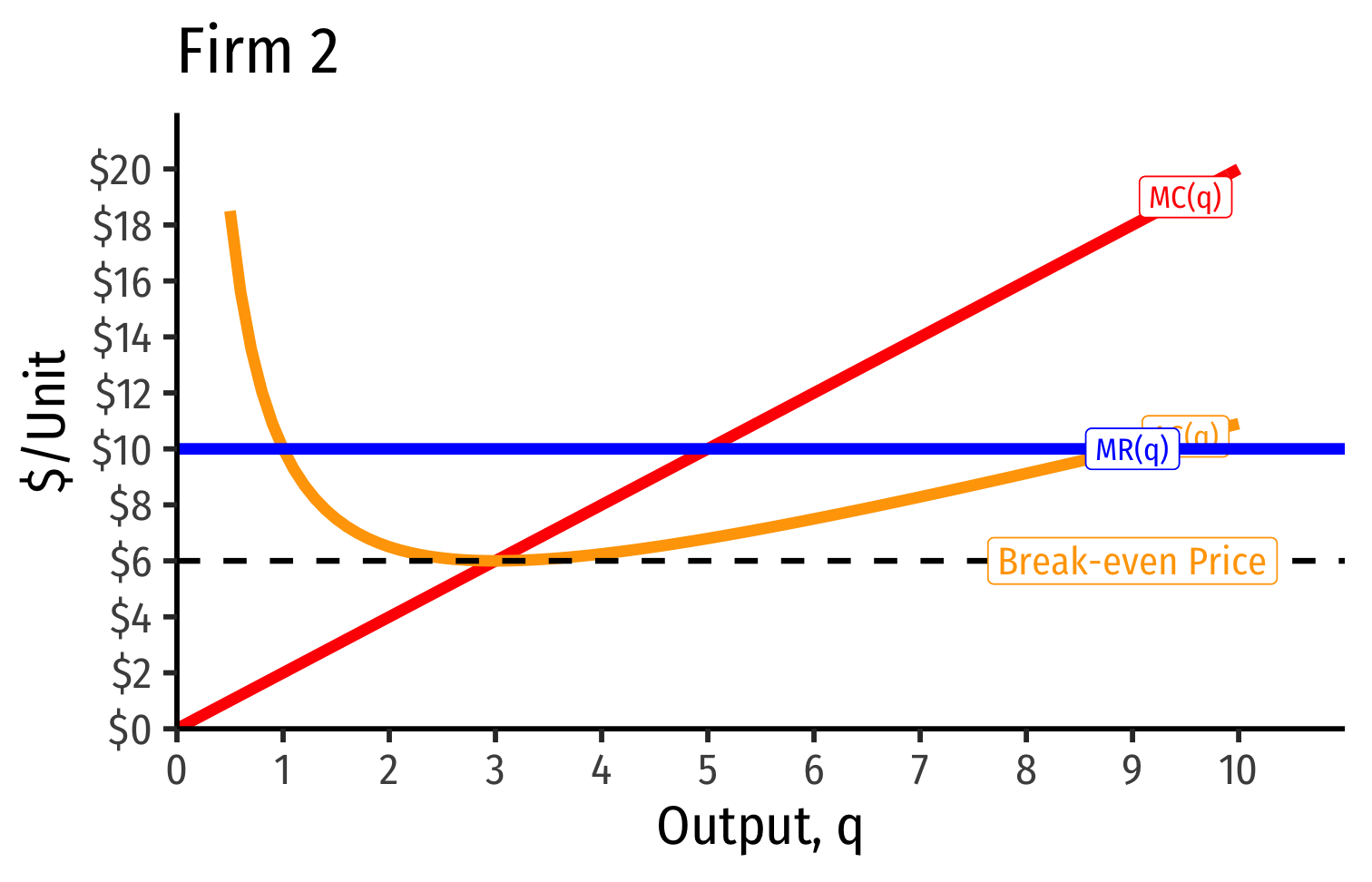

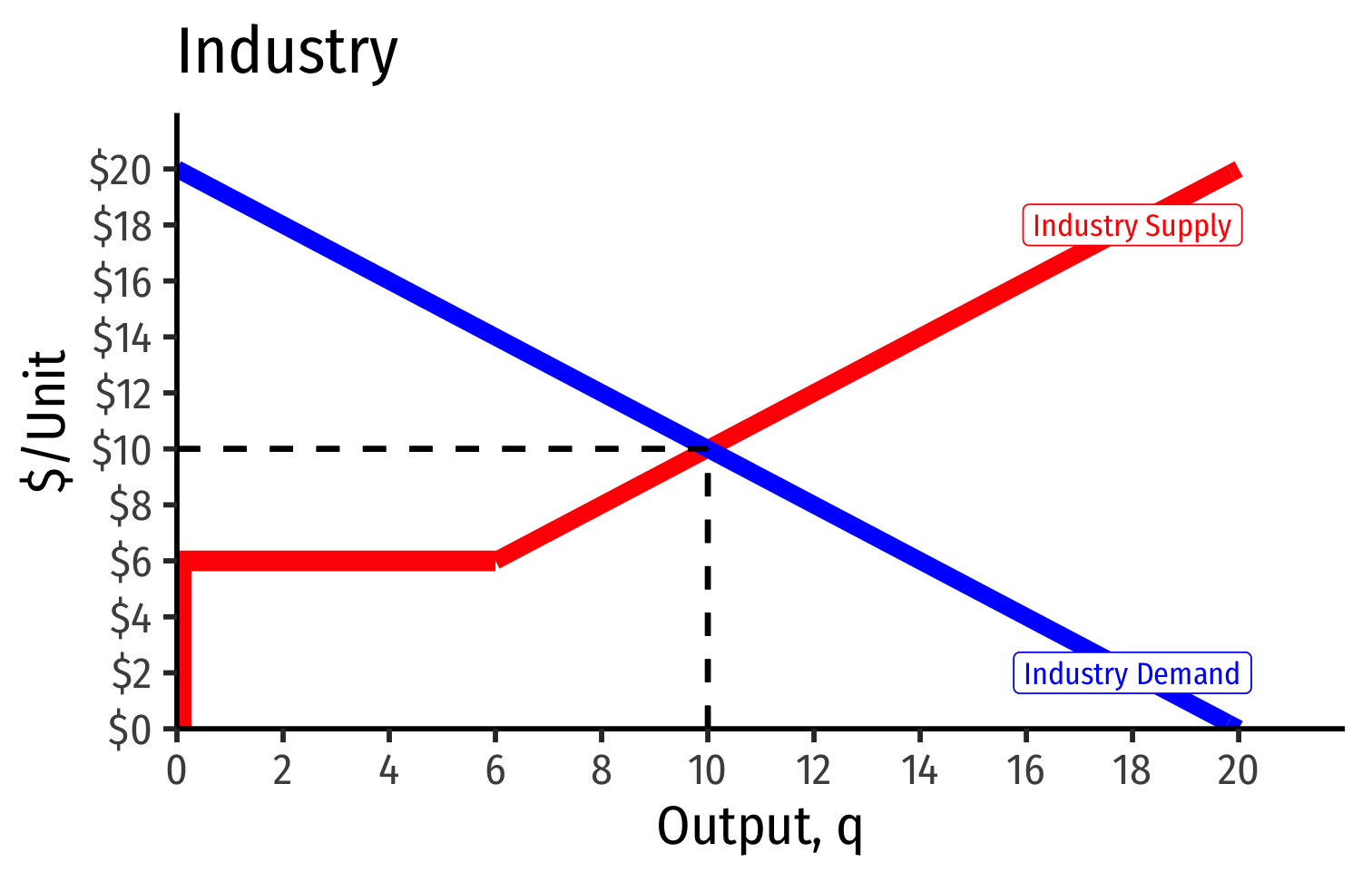

Industry Supply Curves (Identical Firms)

Industry Supply Curves (Identical Firms)

- Industry supply curve is the horizontal sum of all individual firm's supply curves

- Which are each firm's marginal cost curve above its breakeven price

Industry Supply Curves (Identical Firms)

- Industry demand curve (where equal to supply) sets market price, demand for firms

Industry Supply Curves (Identical Firms)

Short Run: each firm is earning profits \(p>AC(q)\)

Long run: induces entry by firm 3, firm 4, \(\cdots\), firm \(n\)

Industry Supply Curves (Identical Firms)

Short Run: each firm is earning profits \(p>AC(q)\)

Long run: induces entry by firm 3, firm 4, \(\cdots\), firm \(n\)

- Long run industry equilibrium:

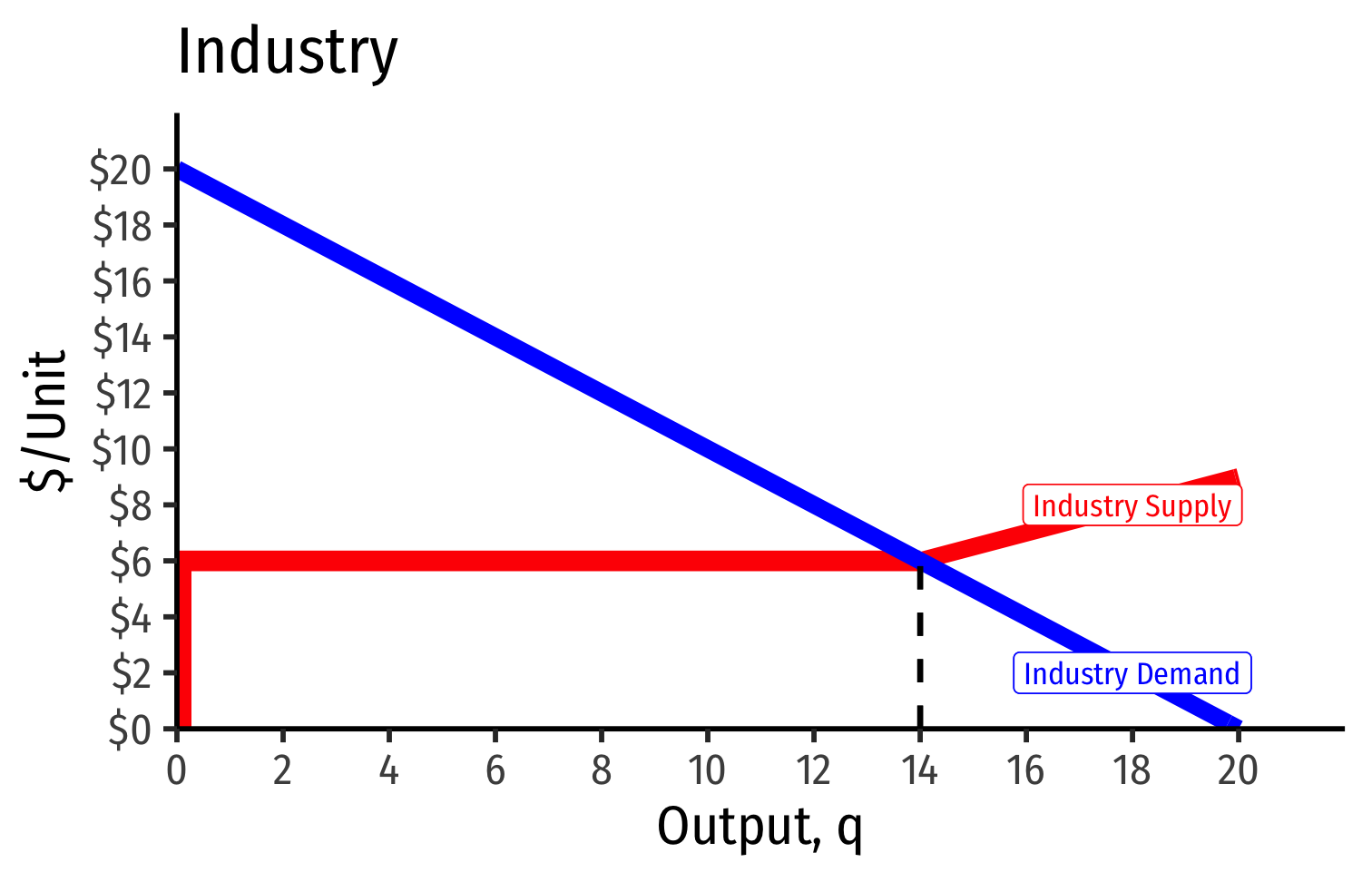

Industry Supply Curves (Identical Firms)

Short Run: each firm is earning profits \(p>AC(q)\)

Long run: induces entry by firm 3, firm 4, \(\cdots\), firm \(n\)

Long run industry equilibrium: \(p=AC(q)_{min}\), \(\pi=0\) at \(p=\) $6; supply becomes more elastic

Zero Economic Profits & Economic Rents

Back to Zero Economic Profits

- Recall, we've essentially defined a firm as a completely replicable recipe (production function) of resources

$$q=f(L,K)$$

- “Any idiot” can enter market, buy required \((L,K)\) at prices \((w,r)\), produce \(q^*\) at market price \(p\) and earn the market rate of \(\pi\)

Back to Zero Economic Profits

Zero long run economic profit \(\neq\) industry disappears, just stops growing

Less attractive to entrepreneurs & start ups to enter than other, more profitable industries

These are mature industries (again, often commodities), the backbone of the economy, just not sexy!

Back to Zero Economic Profits

All factors being paid their market price

- i.e. their opportunity cost - what that they could earn elsewhere in economy

Firms earning normal market rate of return

- No excess rewards (economic profits) to attract new resources into the industry, nor losses to bleed resources out of industry

Back to Zero Economic Profits

But we've so far been imagining a market where every firm is identical, just a recipe “any idiot” can copy

What about if firms have different technologies or costs?

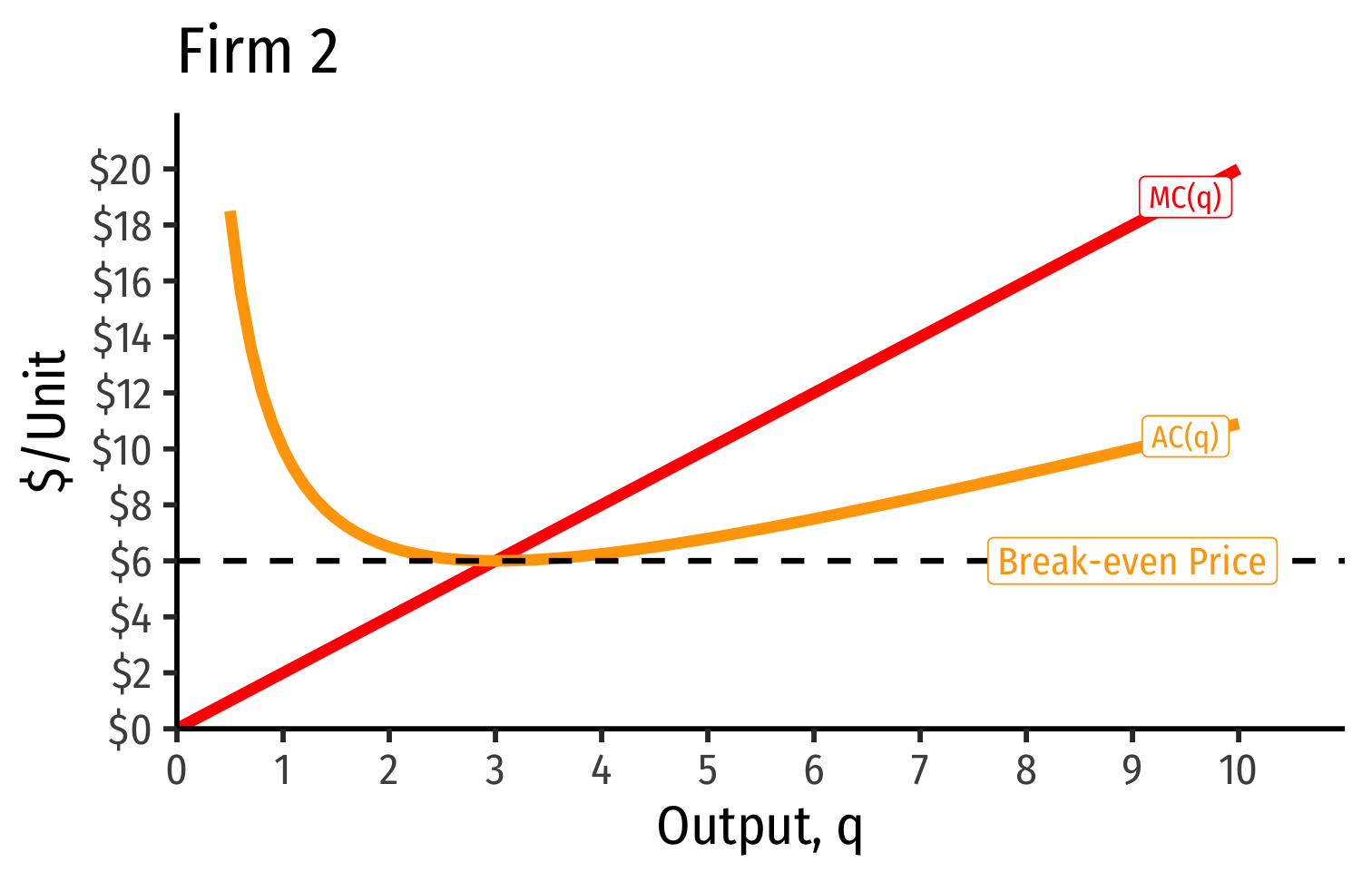

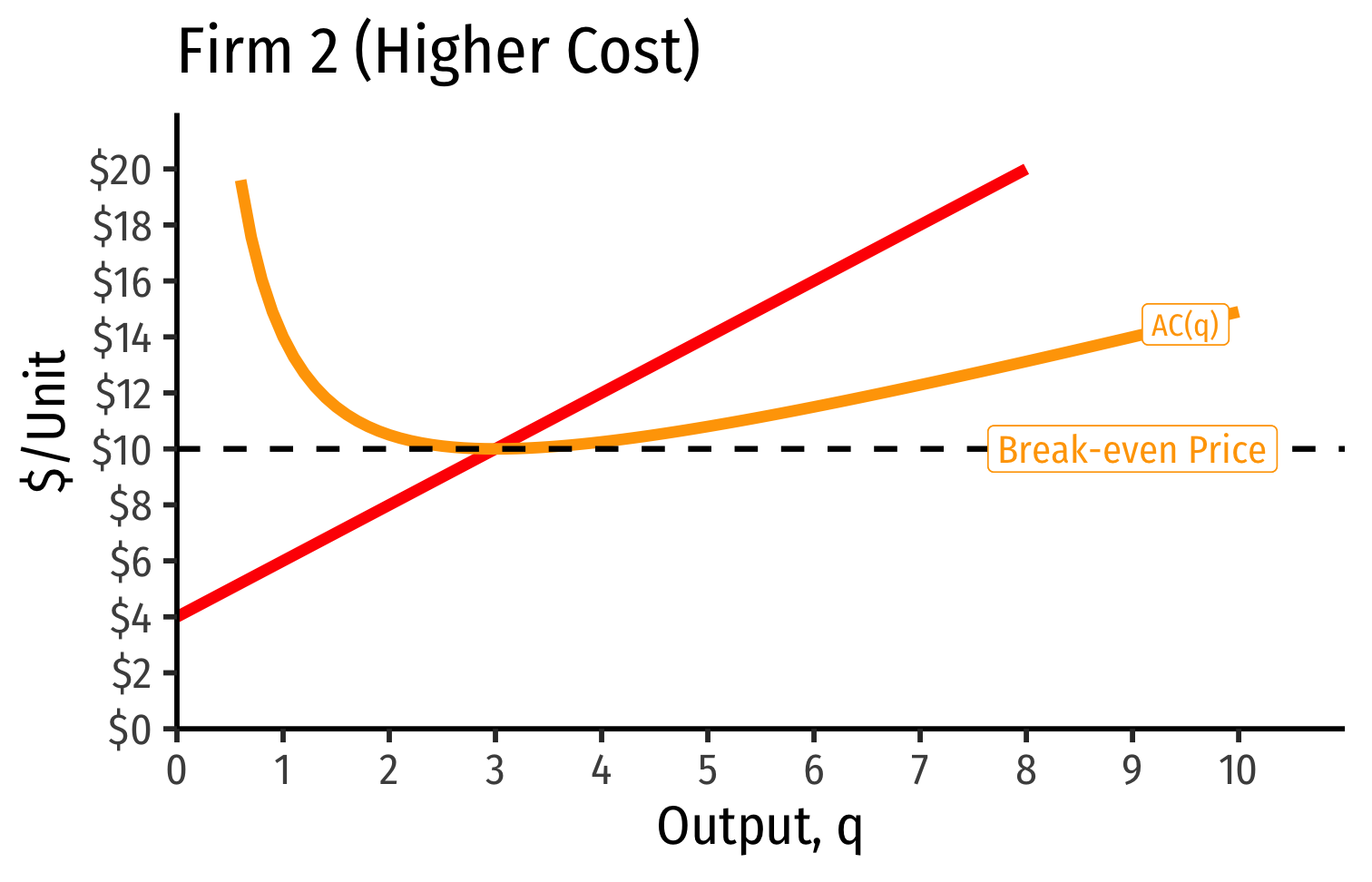

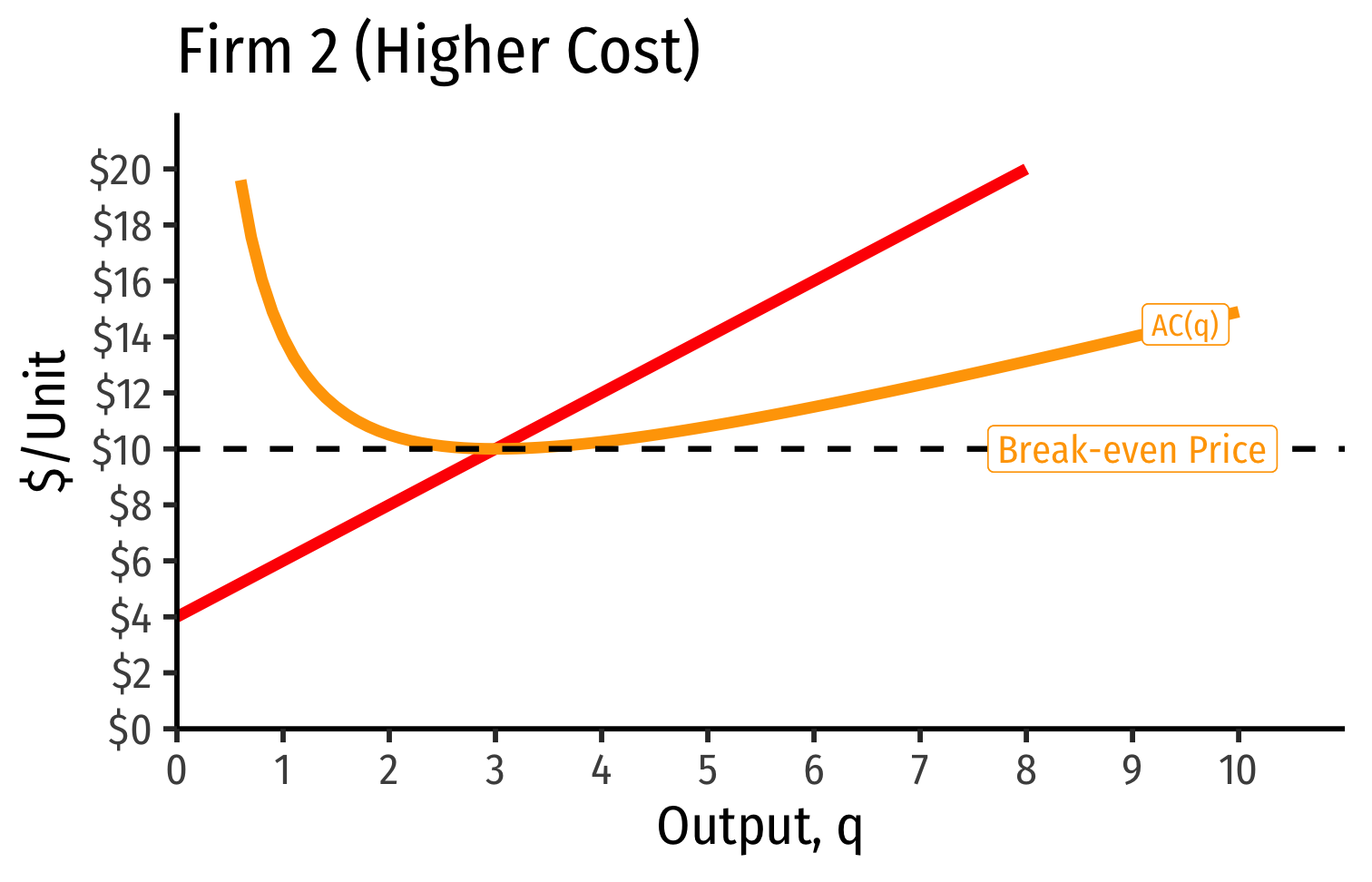

Industry Supply Curves (Different Firms) I

Firms have different technologies/costs due to relative differences in:

- Managerial talent

- Worker talent

- Location

- First-mover advantage

- Technological secrets/IP

- License/permit access

- Political connections

- Lobbying

Let's derive industry supply curve again, and see if this may affact profits

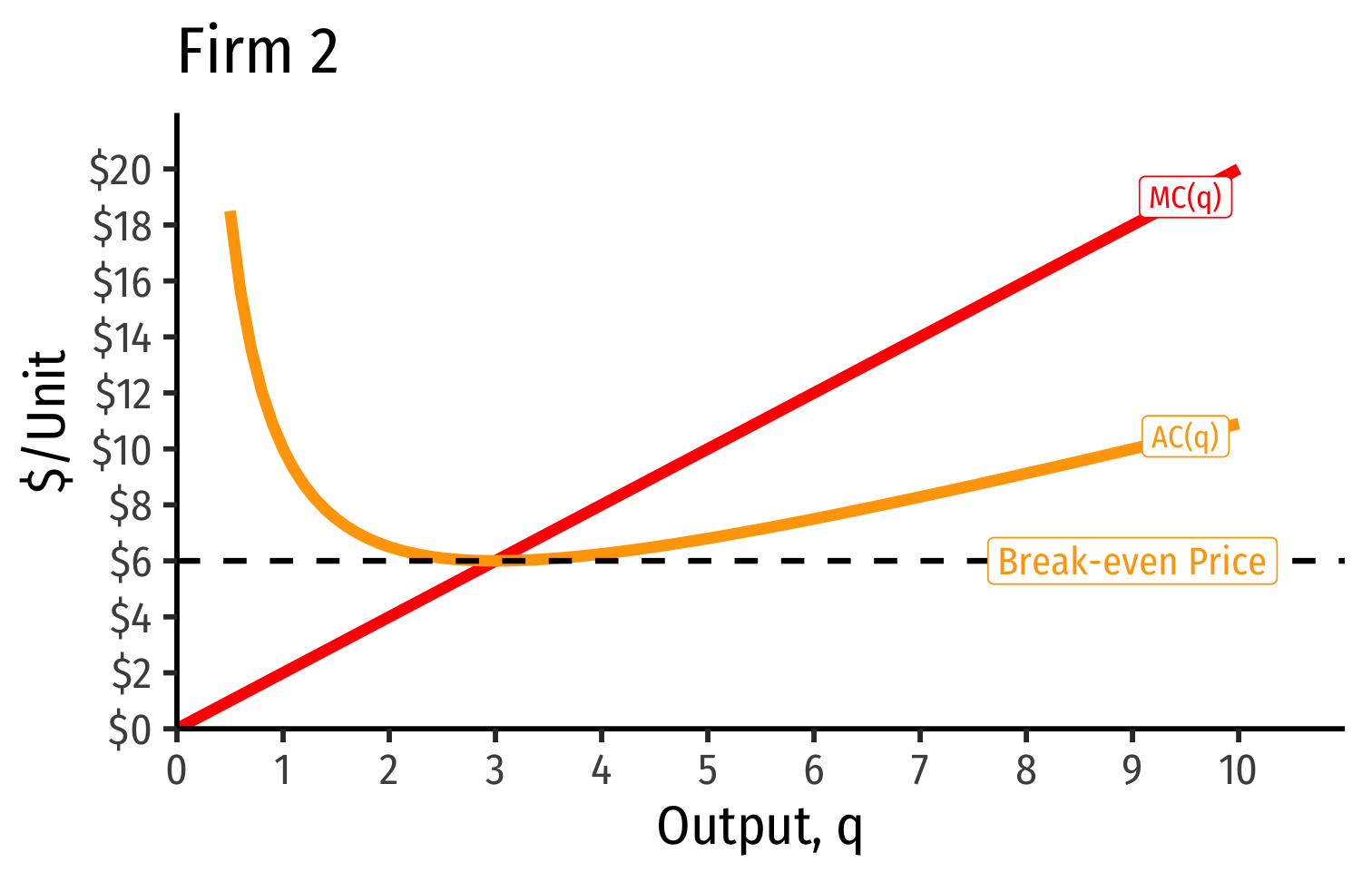

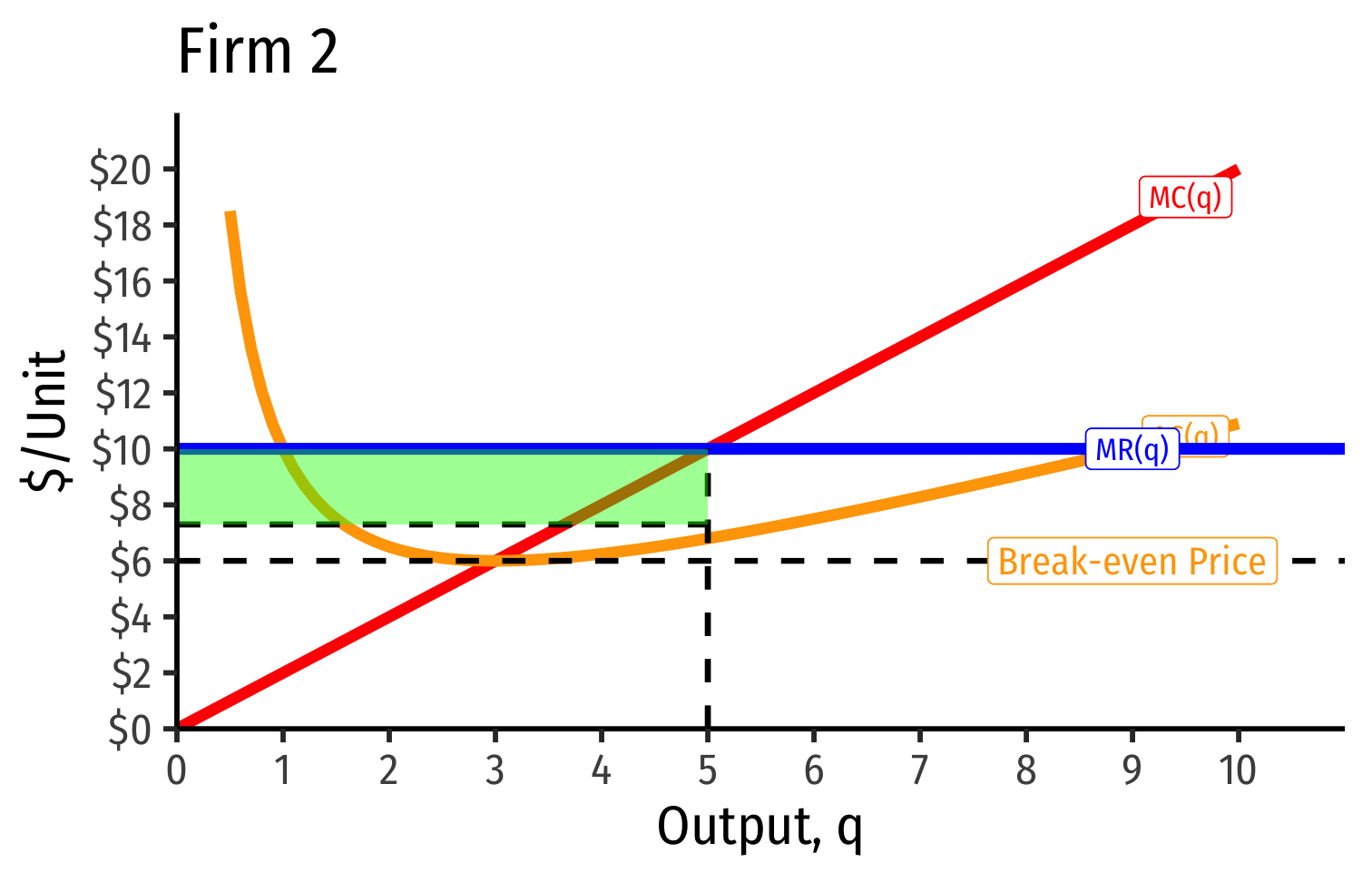

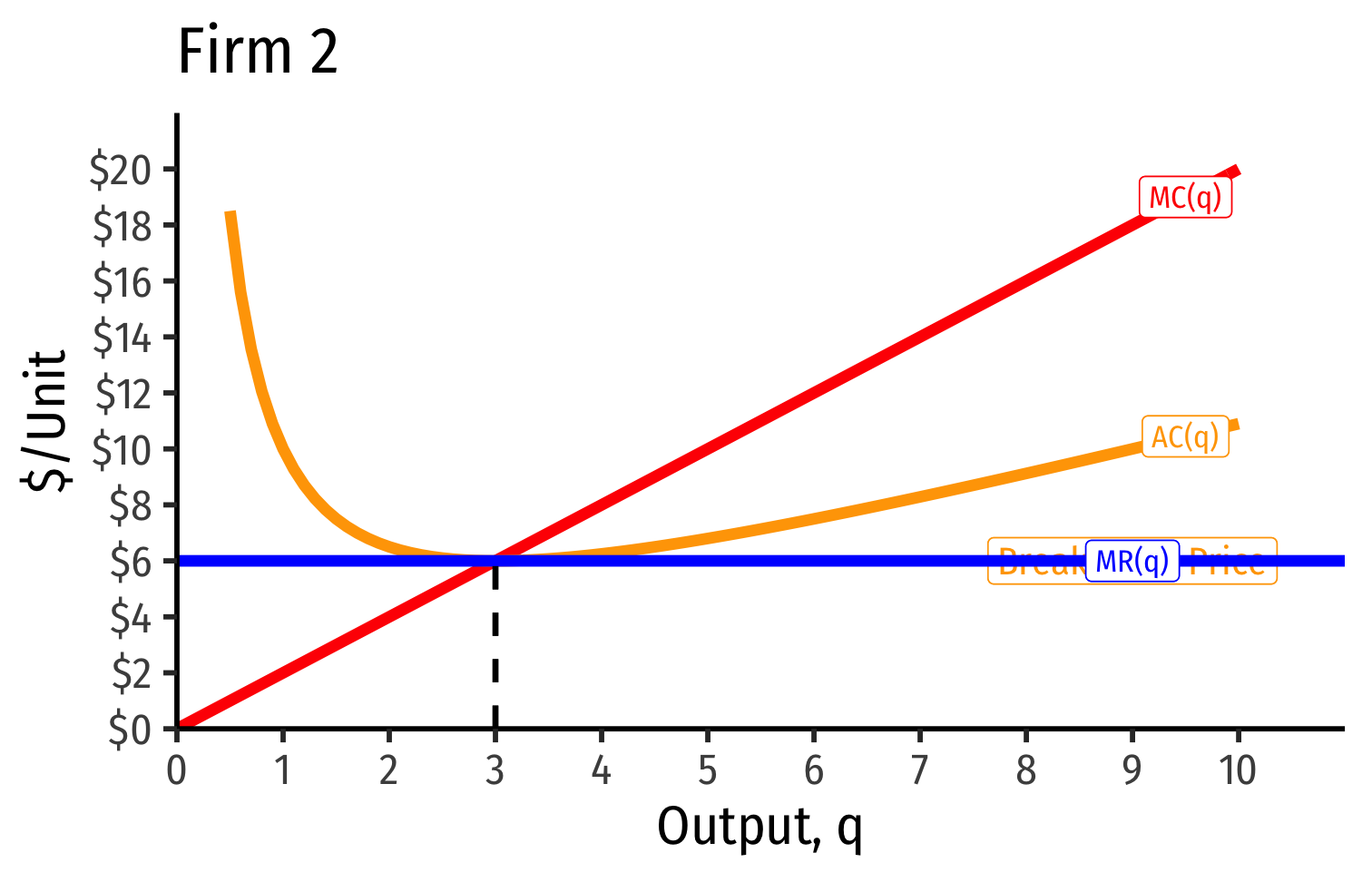

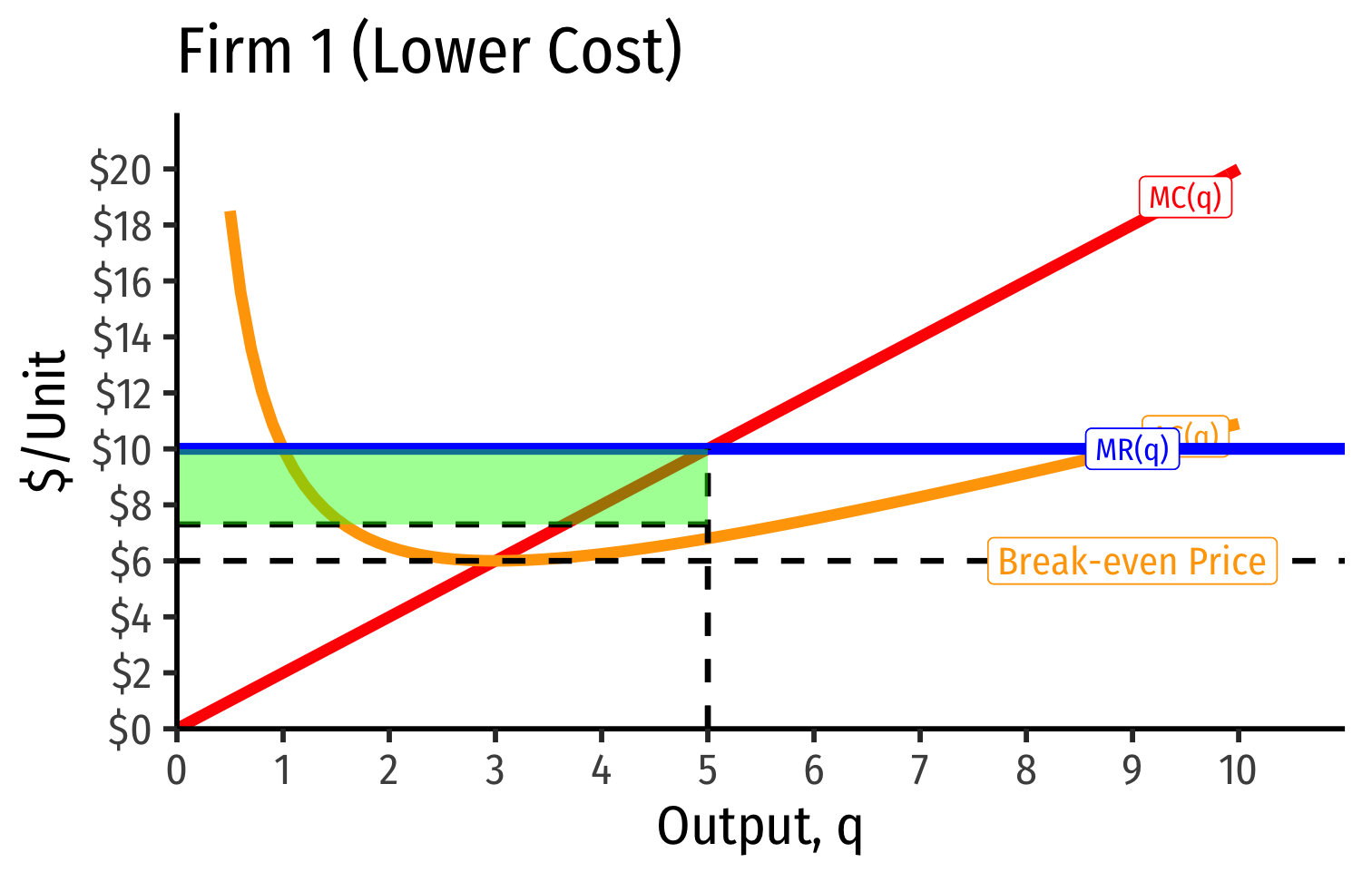

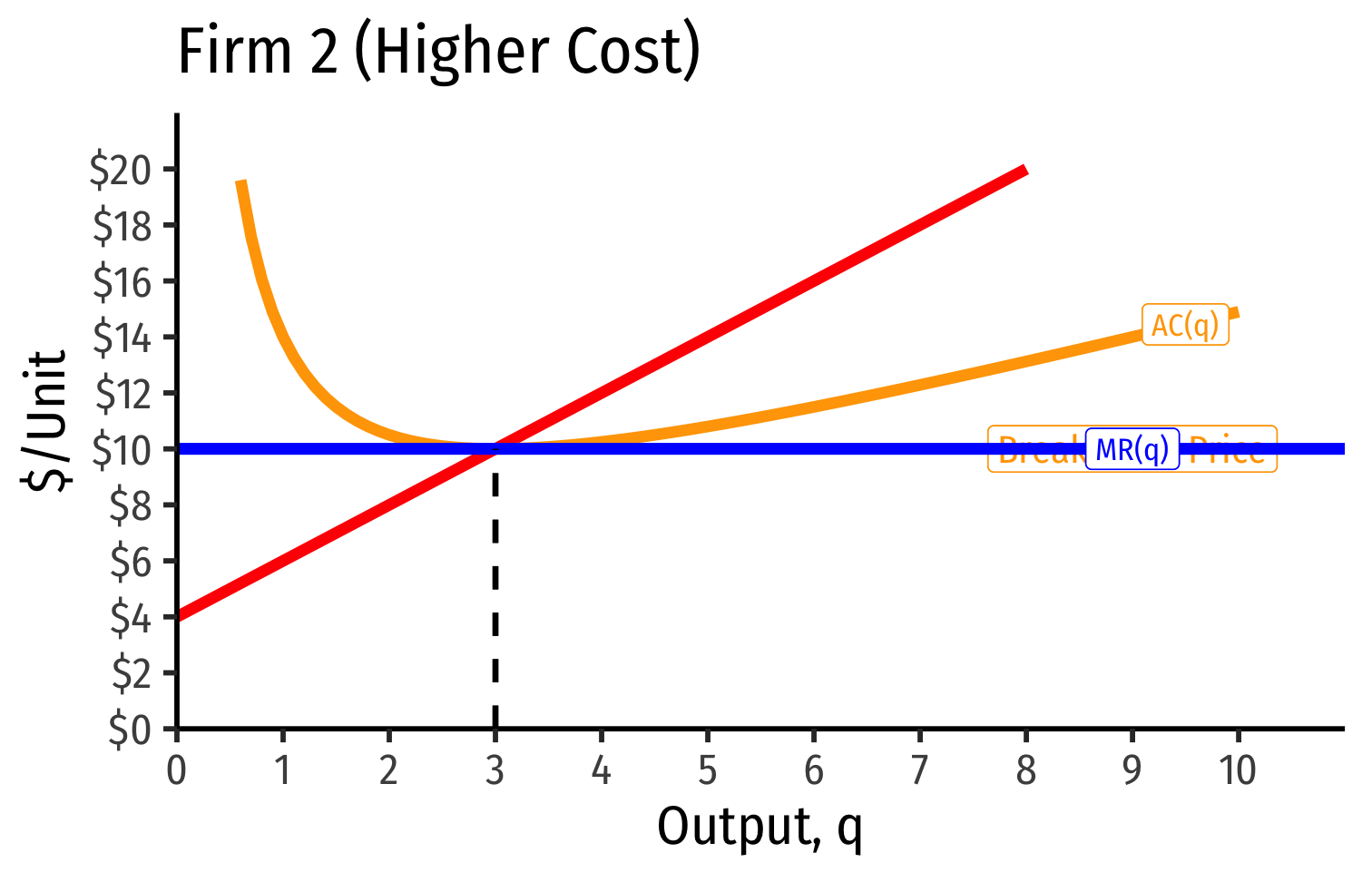

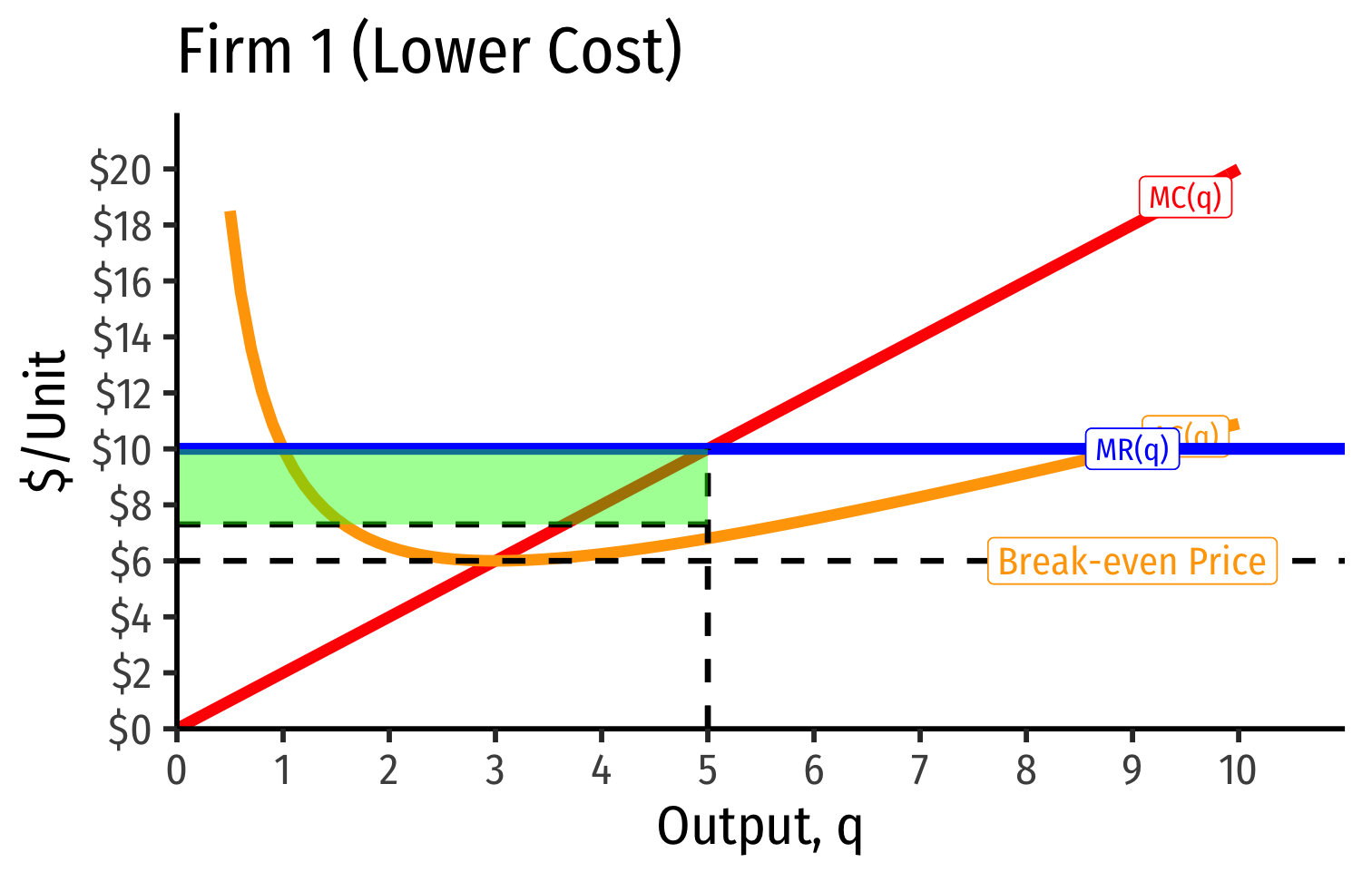

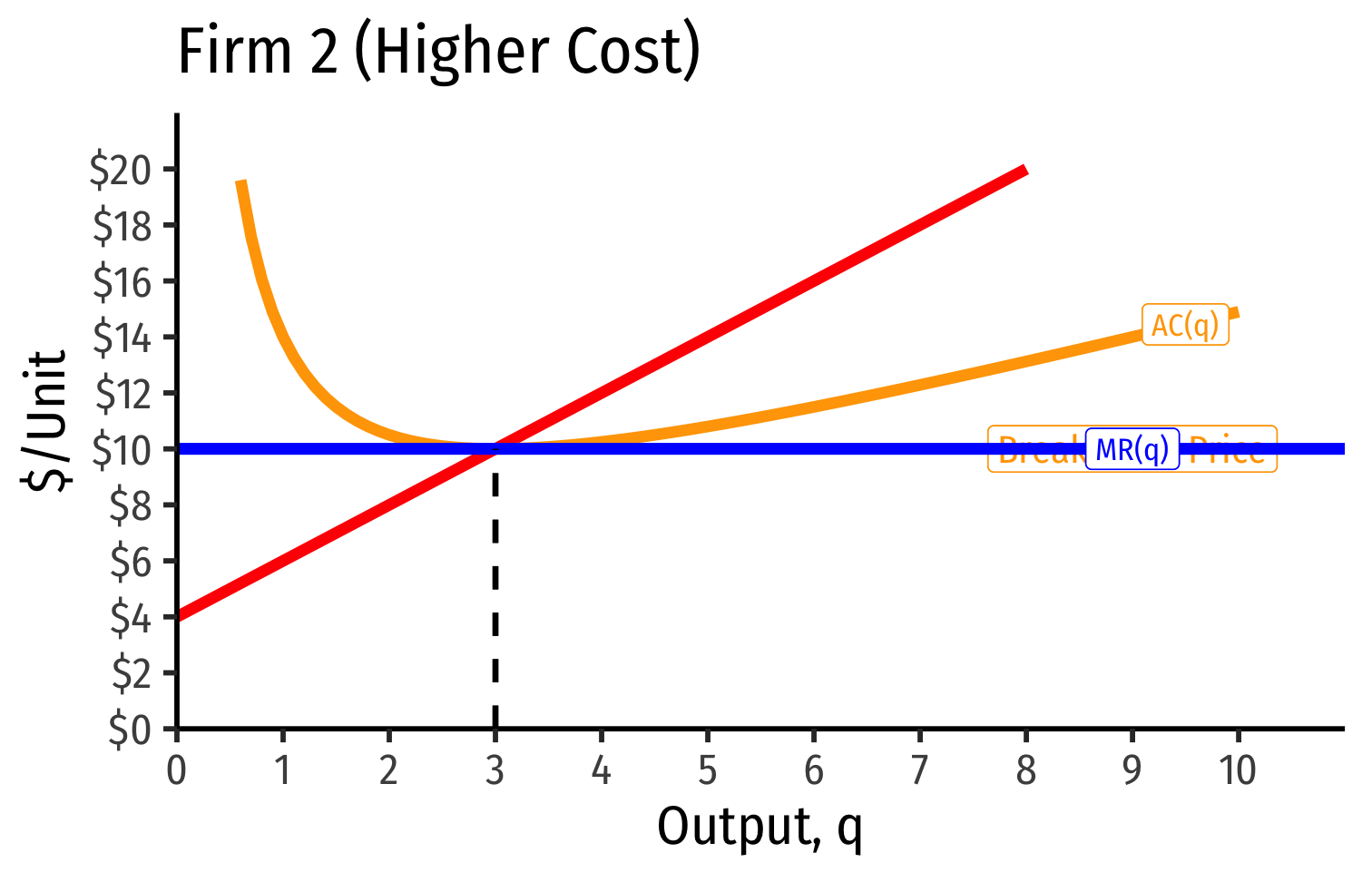

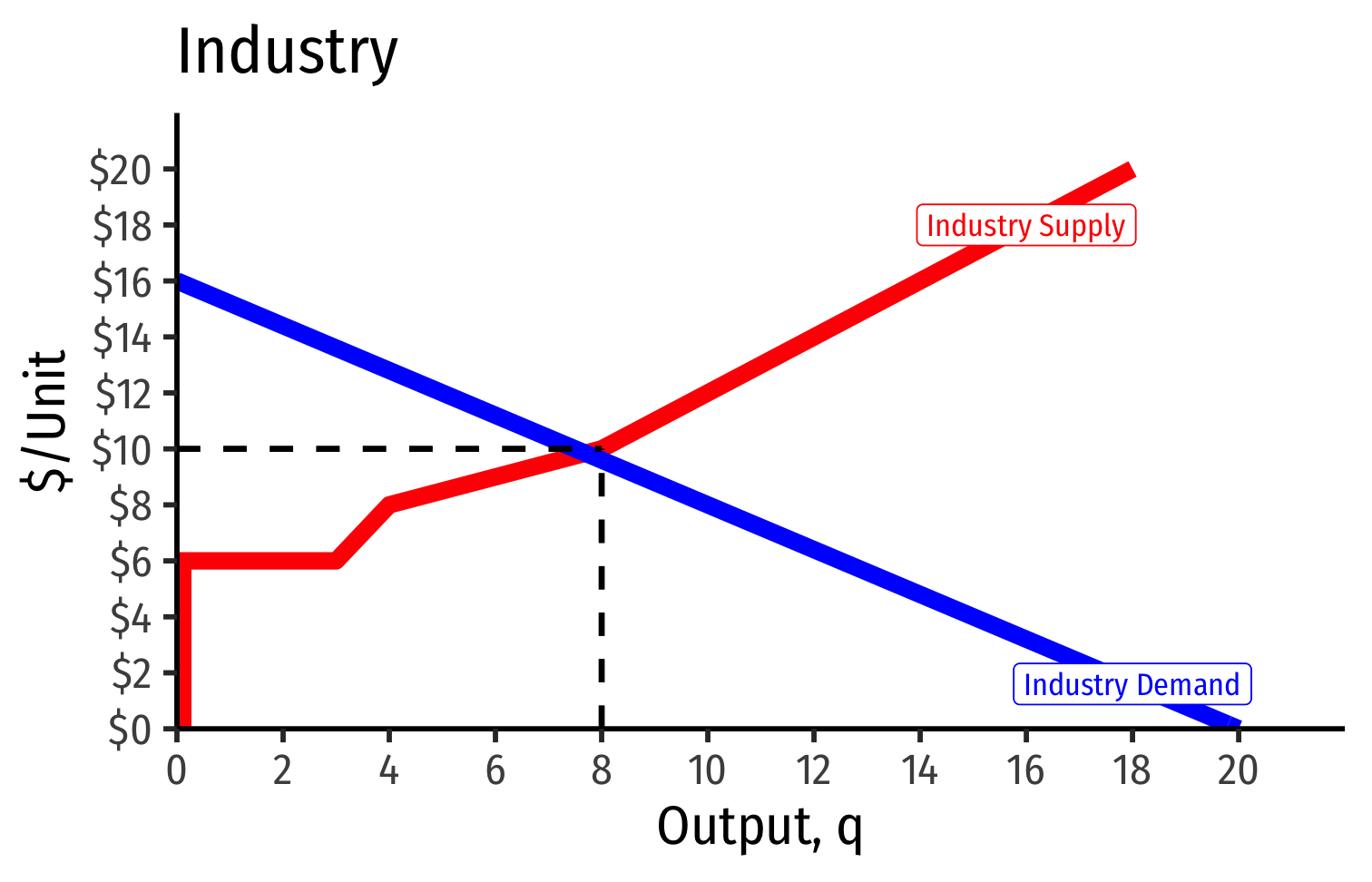

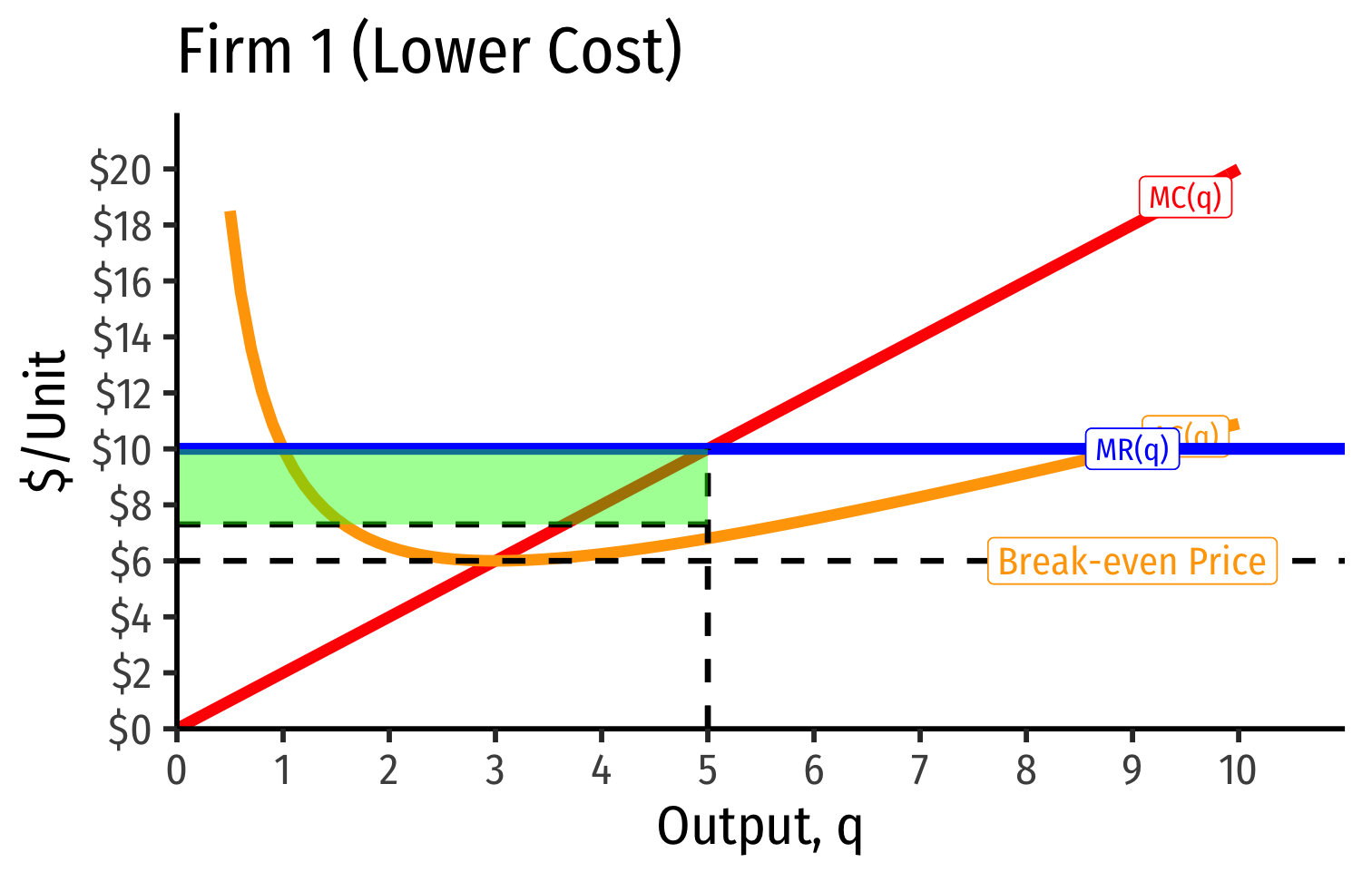

Industry Supply Curves (Different Firms) II

Industry Supply Curves (Different Firms) II

- Industry supply curve is the horizontal sum of all individual firm's supply curves

- Which are each firm's marginal cost curve above its breakeven price

Industry Supply Curves (Different Firms) II

Industry Supply Curves (Different Firms) II

- Industry demand curve (where equal to supply) sets market price, demand for firms

Industry Supply Curves (Different Firms) II

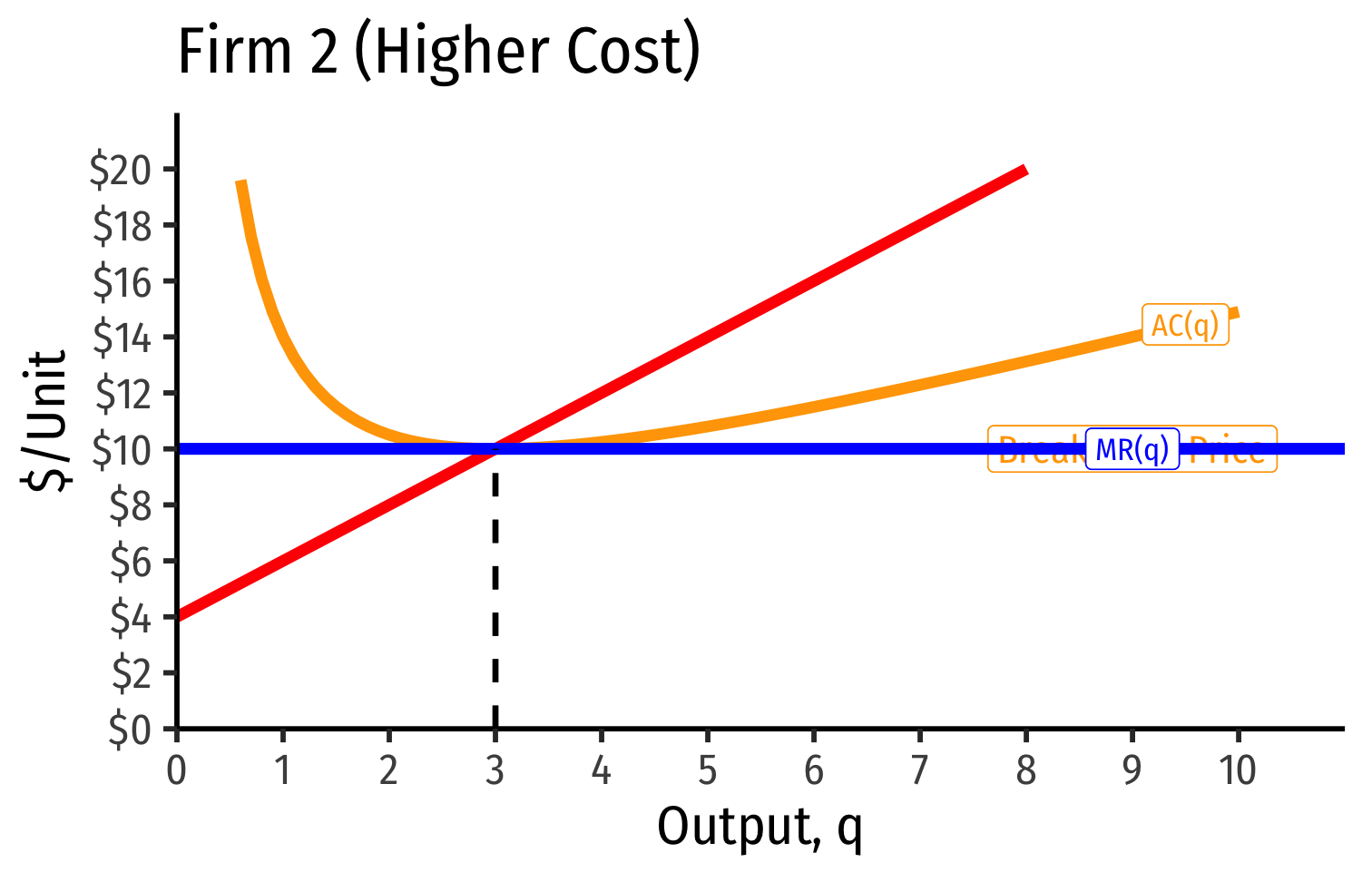

- Industry demand curve (where equal to supply) sets market price, demand for firms

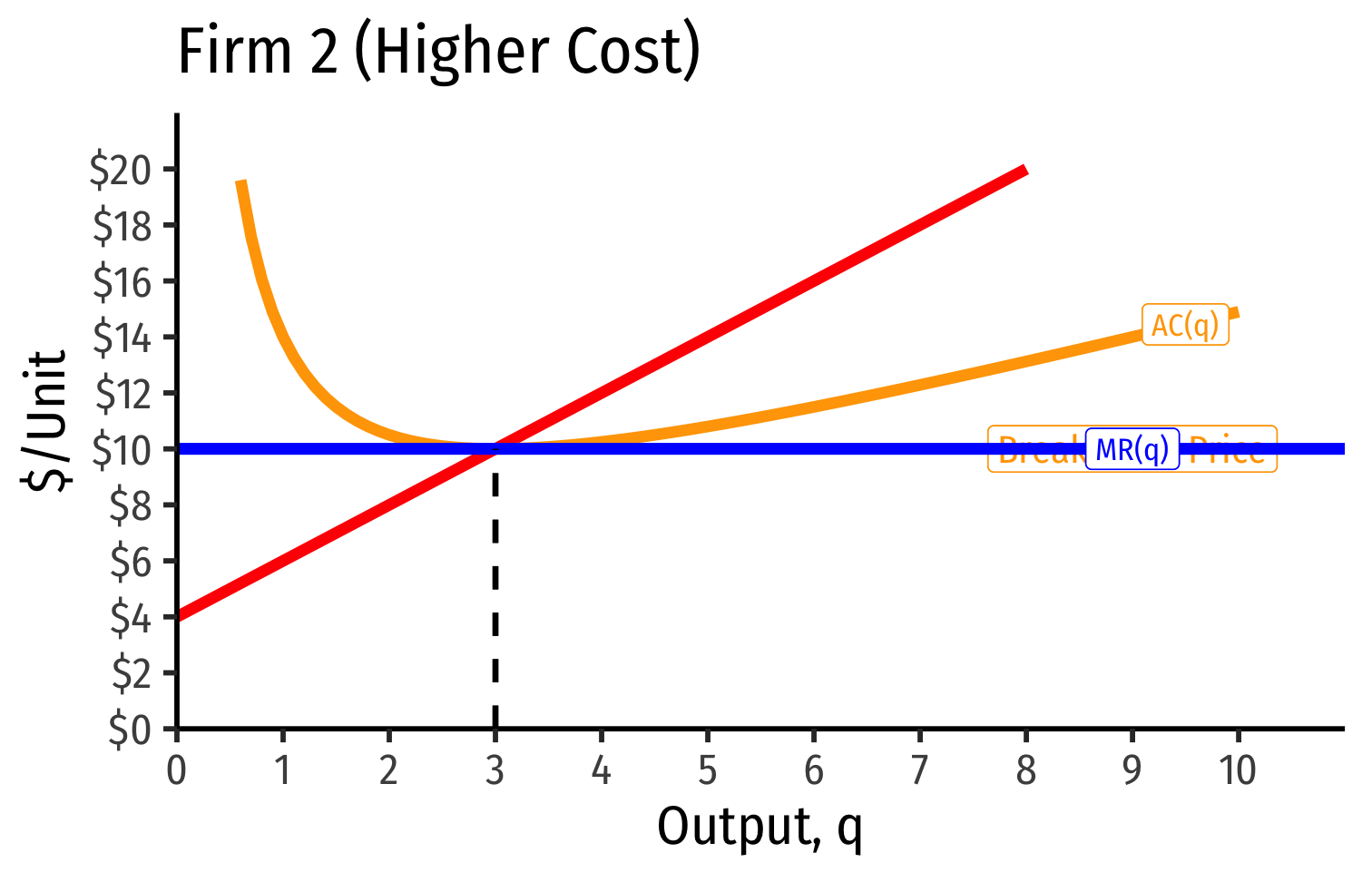

- Long run industry equilibrium: \(p=AC(q)_{min}\), \(\pi=0\) for marginal (highest cost) firm (Firm 2)

Industry Supply Curves (Different Firms) II

- Industry demand curve (where equal to supply) sets market price, demand for firms

- Long run industry equilibrium: \(p=AC(q)_{min}\), \(\pi=0\) for marginal (highest cost) firm (Firm 2)

- Firm 1 (lower cost) appears to be earning profits...

Economic Rents and Zero Economic Profits I

- With differences between firms, long-run equilibrium \(p=AC(q)_{min}\) of the marginal (highest-cost) firm

- If \(p>AC(q)\) for that firm, would induce more entry into industry!

Economic Rents and Zero Economic Profits I

“Inframarginal” (lower-cost) firms earn economic rents

- returns higher than their opportunity cost (what is needed to bring them into this industry)

Economic rents arise from relative differences between firms

- actually using different inputs!

Economic Rents and Zero Economic Profits III

Some factors are relatively scarce in the whole economy

- (talent, location, secrets, IP, licenses, being first, political favoritism)

Inframarginal firms that use these scarce factors gain an advantage

It would seem these firms earn profits, as they have loewr costs...

- ...But what will happen to the prices for the scarce factors over time?

Economic Rents and Zero Economic Profits IV

Rival firms willing to pay for rent-generating factor to gain advantage

Competition over acquiring the scarce factors push up their prices

- i.e. costs to firms of using the factor!

Rents are included in the opportunity cost (price) for inputs over long run

- Must pay a factor enough to keep it out of other uses

Economic Rents and Zero Economic Profits V

Economic rents \(\neq\) economic profits!

- Rents actually reduce profits!

Firm does not earn the rents, they raise firm's costs and squeeze out profits!

Scarce factor owners (workers, landowners, inventors, etc) earn the rents as higher income for their scarce services (wages, rents, interest, royalties, etc).

Recall: Accounting vs. Economic Point of View

Recall “economic point of view”:

Producing your product pulls scarce resources out of other productive uses in the economy

Profits attract resources: pulled out of other (less valuable) uses

Losses repel resources: pulled away to other (more valuable) uses

Zero profits \(\implies\) resources stay where they are

- Optimal social use of resources!

Supply Functions

Supply Function

- Supply function relates quantity to price

Example: $$q=2p-4$$

- Not graphable (wrong axes)!

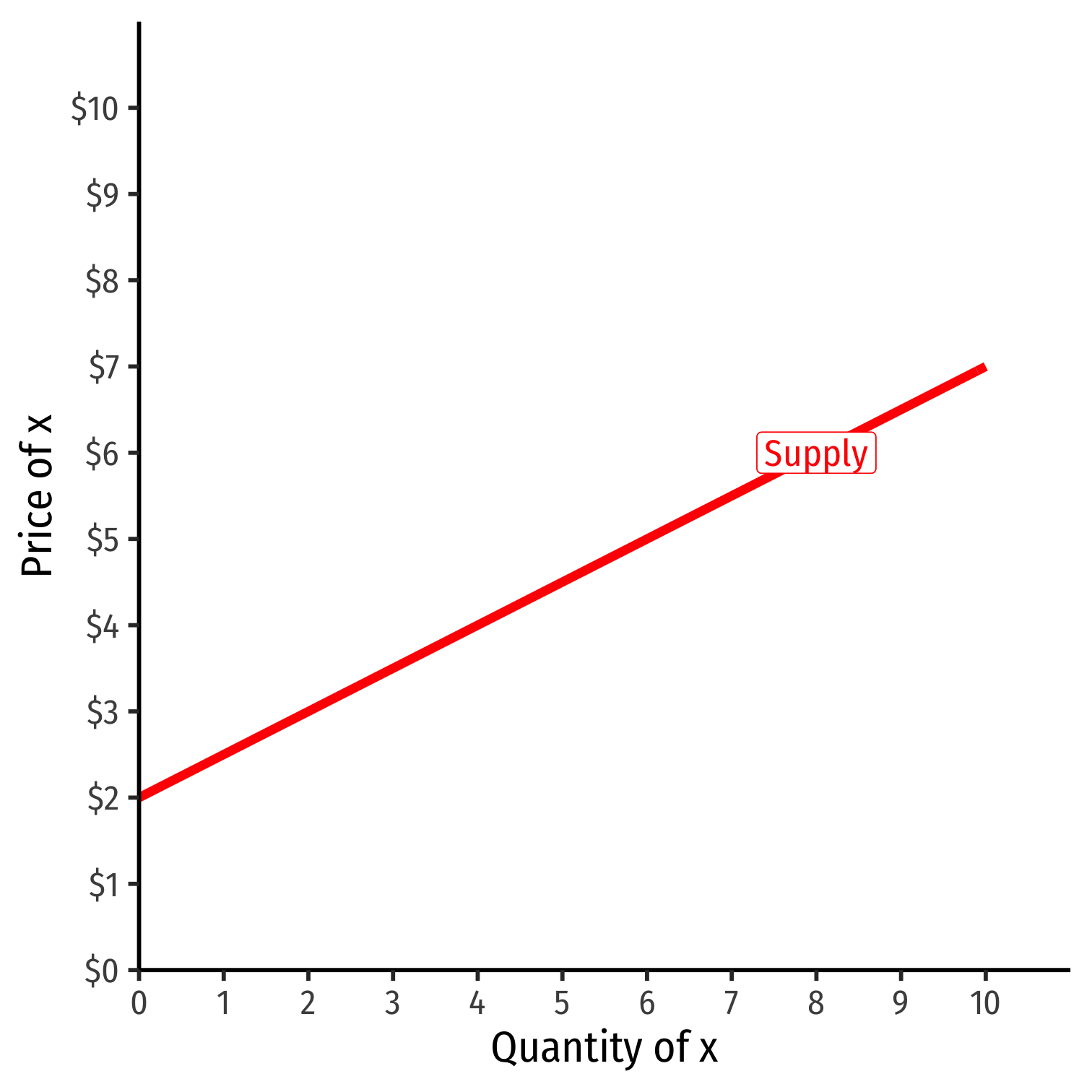

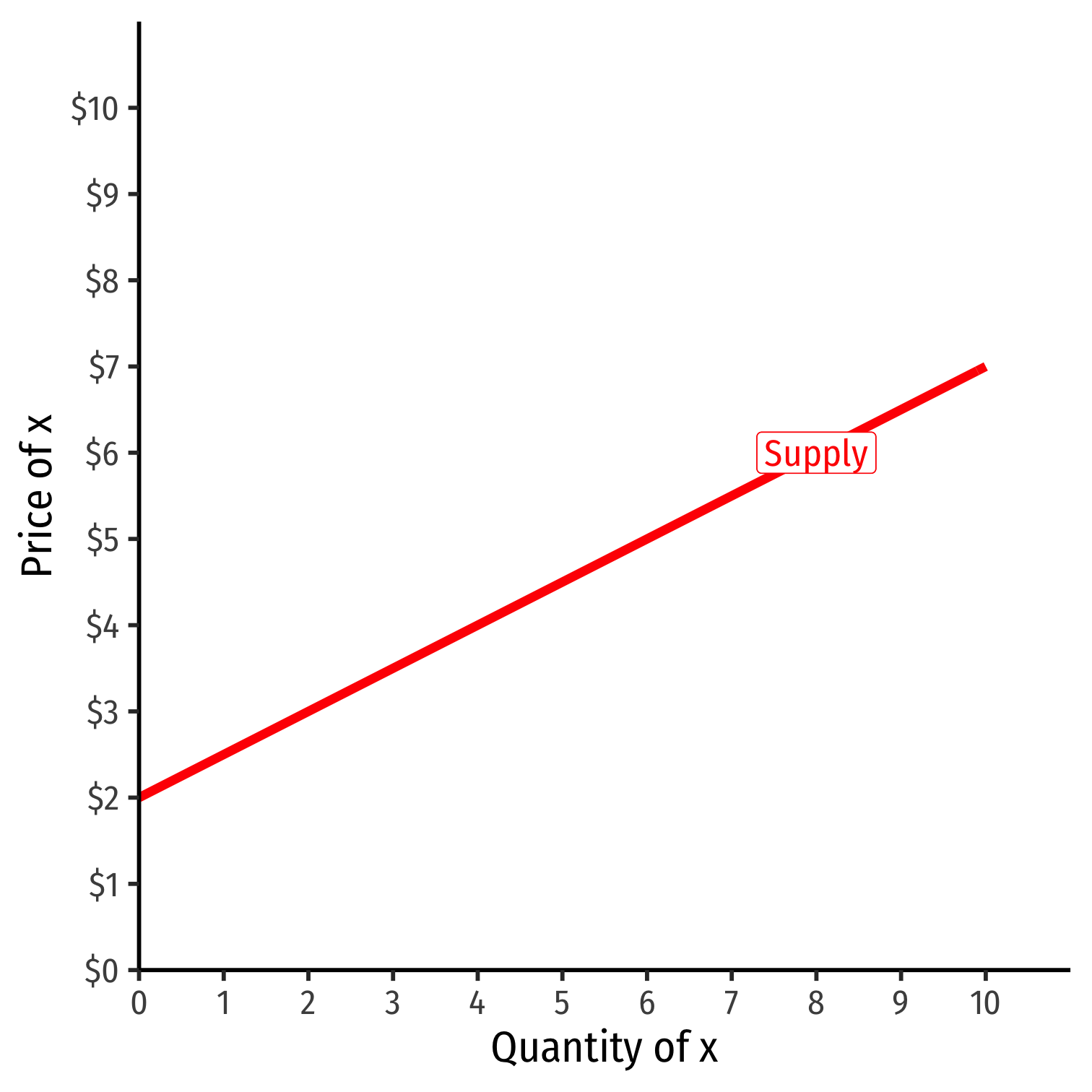

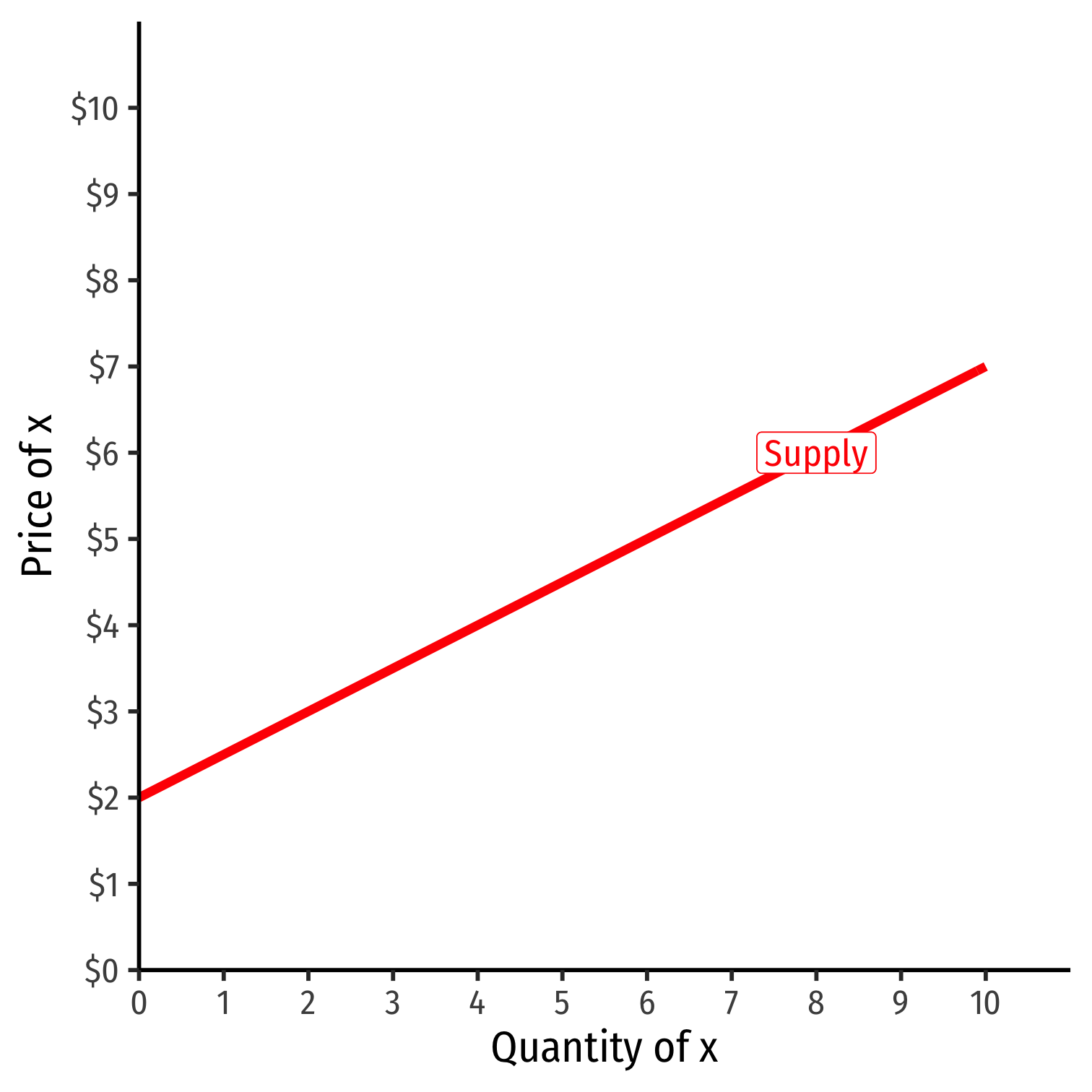

Inverse Supply Function

- Inverse supply function relates price to quantity

- Take supply function, solve for \(p\)

Example: $$p=2+0.5q$$

- Graphable (price on vertical axis)!

Inverse Supply Function

- Inverse supply function relates price to quantity

- Take supply function, solve for \(p\)

Example: $$p=2+0.5q$$

- Graphable (price on vertical axis)!

Inverse Supply Function

Example: $$p=2+0.5q$$

Slope: 0.5

Vertical intercept called the "Choke price": price where \(q_S=0\) ($2), just low enough to discourage any sales

Inverse Supply Function

Read two ways:

Horizontally: at any given price, how many units firm wants to sell

Vertically: at any given quantity, the minimum willingness to accept (WTA) for that quantity

Price Elasiticity of Supply

Price Elasticity of Supply

- Price elasticity of supply measures how much (in %) quantity supplied changes in response to a (1%) change in price

$$\epsilon_{q_S,p} = \frac{\% \Delta q_S}{\% \Delta p}$$

Price Elasticity of Supply: Elastic vs. Inelastic

$$\epsilon_{q_S,p} = \frac{\% \Delta q_S}{\% \Delta p}$$

| "Elastic" | "Unit Elastic" | "Inelastic" | |

|---|---|---|---|

| Intuitively: | Large response | Proportionate response | Little response |

| Mathematically: | \(\epsilon_{q_s,p} > 1\) | \(\epsilon_{q_s,p} = 1\) | \(\epsilon_{q_s,p} < 1\) |

| Numerator \(>\) Denominator | Numerator \(=\) Denominator | Numerator \(<\) Denominator | |

| A 1% change in \(p\) | More than 1% change in \(q_S\) | 1% change in \(q_S\) | Less than 1% change in \(q_S\) |

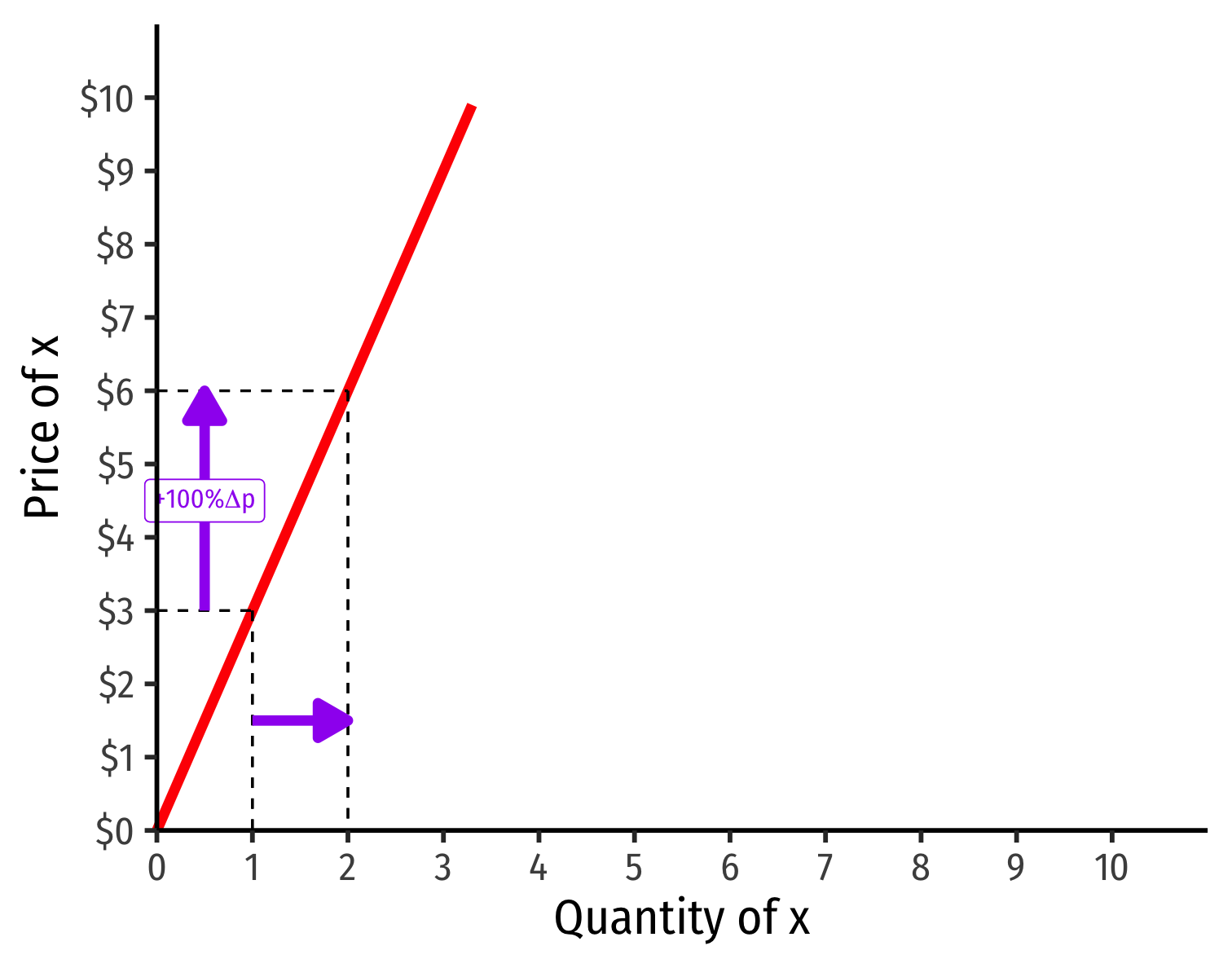

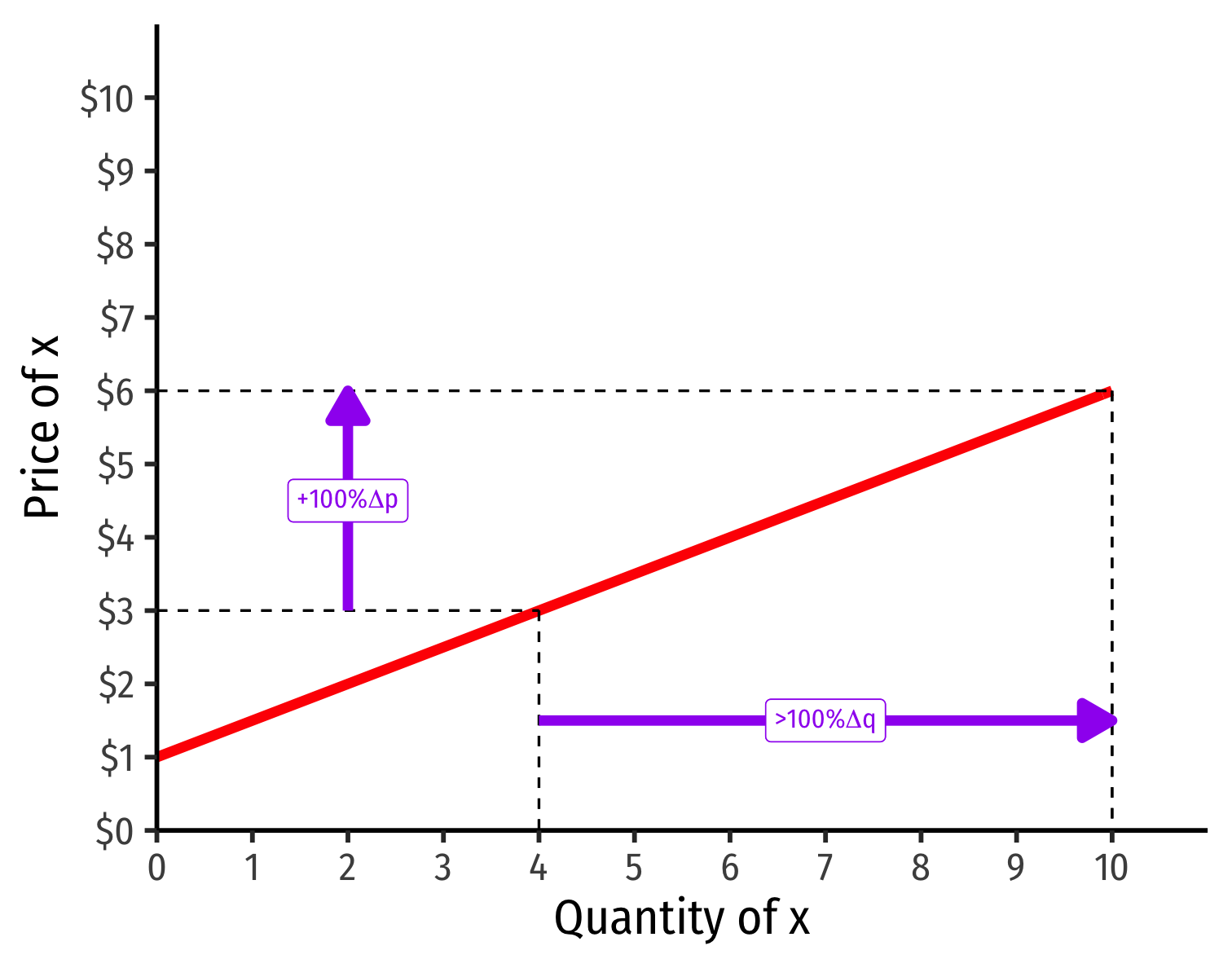

Visualizing Price Elasticity of Supply

An identical 100% price increase on an:

"Inelastic" Supply Curve

"Elastic" Supply Curve

Price Elasticity of Supply Formula

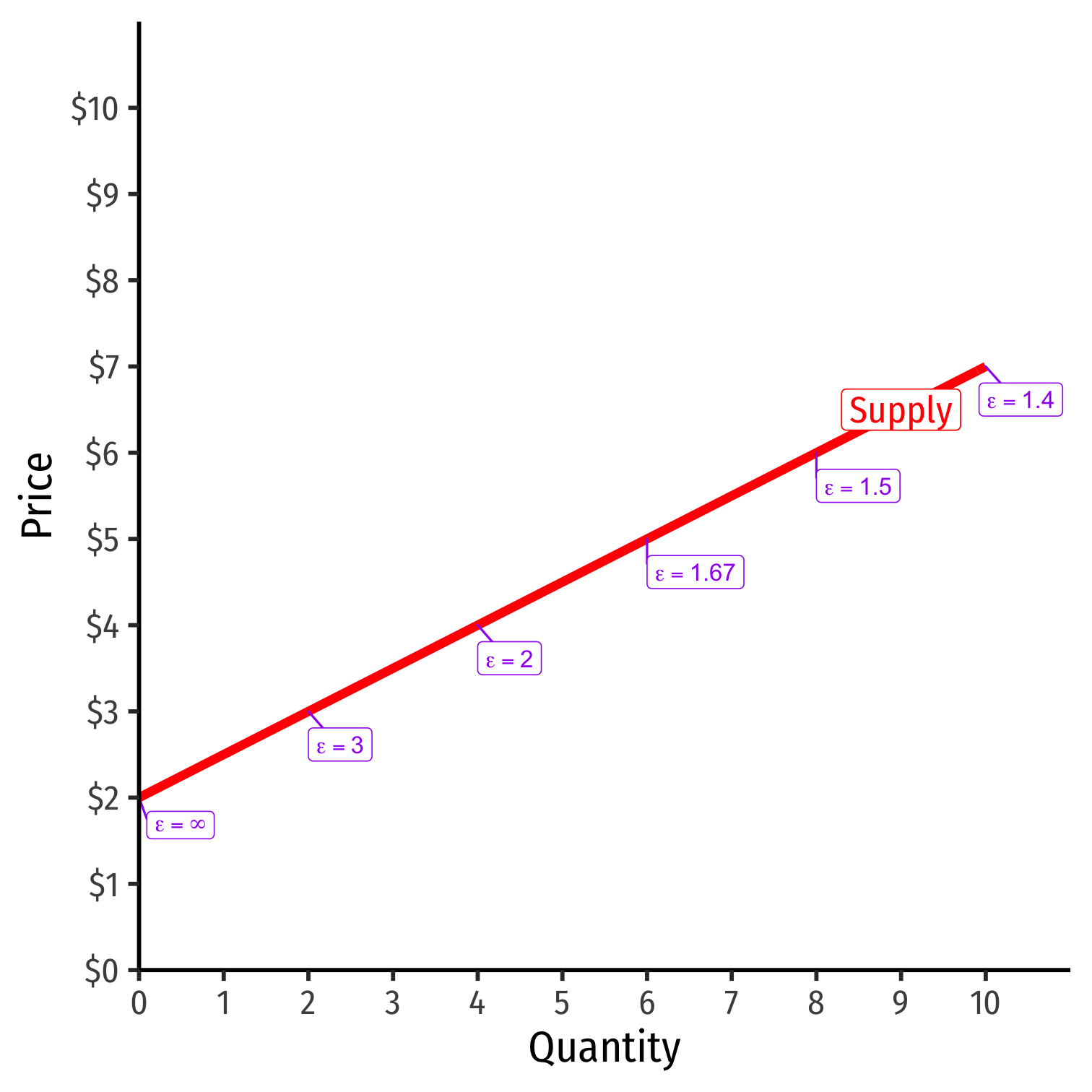

$$\epsilon_{q,p} = \mathbf{\frac{1}{slope} \times \frac{p}{q}}$$

First term is the inverse of the slope of the inverse supply curve (that we graph)!

To find the elasticity at any point, we need 3 things:

- The price

- The associated quantity supplied

- The slope of the (inverse) supply curve

Example

Example: The supply of bicycle rentals in a small town is given by:

$$q_S=10p-200$$

Find the inverse supply function.

What is the price elasticity of supply at a price of $25.00?

What is the price elasticity of supply at a price of $50.00?

Price Elasticity of Supply Changes Along the Curve

$$\epsilon_{q,p} = \mathbf{\frac{1}{slope} \times \frac{p}{q}}$$

Elasticity \(\neq\) slope (but they are related)!

Elasticity changes along the supply curve

Often gets less elastic as \(\uparrow\) price \((\uparrow\) quantity)

- Harder to supply more

Determinants of Price Elasticity of Supply I

What determines how responsive your selling behavior is to a price change?

The faster (slower) costs increase with output \(\implies\) less (more) elastic supply

- Mining for natural resources vs. automated manufacturing

Smaller (larger) share of market for inputs \(\implies\) more (less) elastic

- Will your suppliers raise the price much if you buy more?

- How much competition is there in your input markets?

Determinants of Price Elasticity of Supply II

What determines how responsive your selling behavior is to a price change?

- More (less) time to adjust to price changes \(\implies\) more (less) elastic

- Supply of oil today vs. oil in 10 years

Price Elasticity of Supply: Examples

A report by @PIIE found an N-95 respirator mask still faces a 7% U.S. tariff.

— Chad P. Bown (@ChadBown) April 21, 2020

Remaining US duties include

• 5% on hand sanitizer

• 4.5% on protective medical clothing

• 2.5% on goggles

• 6.4-8.3% on other medical headwear

By @ABehsudi 1/https://t.co/LcxE0FFlXO